PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

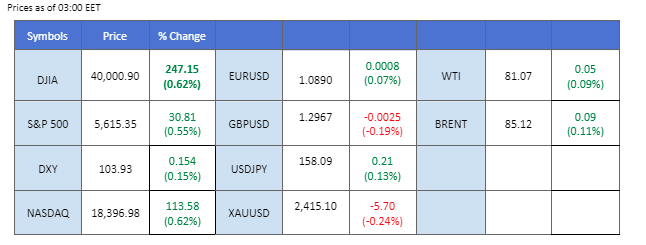

Over the weekend, a significant event unfolded in the U.S. presidential race as candidate Donald Trump was shot at a campaign rally in Pennsylvania, intensifying geopolitical uncertainty across markets. The dollar swiftly reacted, rebounding from recent lows amid expectations that Trump’s fiscal policies, known for potentially boosting treasury yields, could strengthen the currency further.

In the equity markets, U.S. index futures remained stable as investors assessed the implications of the incident on market sentiment. Trump’s status as a crypto-friendly candidate saw his odds of winning increase following the shooting, driving Bitcoin (BTC) prices up by more than 5% to surpass the $61,000 mark since the weekend.

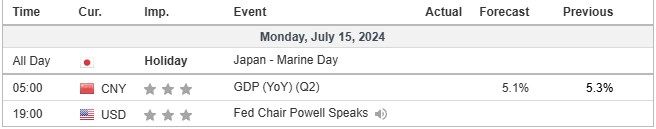

In commodities, gold, known as a safe-haven asset, maintained its upward trajectory above $2,400, supported by ongoing geopolitical concerns in the U.S. Meanwhile, a disappointing Chinese GDP report weighed on oil prices, adding further downward pressure.

Market participants are advised to closely monitor today’s U.S. Retail Sales data for insights into potential impacts on dollar strength amid these evolving geopolitical and economic dynamics.

Current rate hike bets on 31st July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (93.3%) VS -25 bps (6.7%)

(MT4 System Time)

Source: MQL5

The Dollar Index found support near its critical liquidity zone around the $140 level and has shown signs of rebounding from that point. Attention is focused on the recent gunshot incident involving Donald Trump over the weekend, which led to the dollar, considered a safe-haven currency, rising at the beginning of the week. Meanwhile, the market is also eyeing Tuesday’s U.S. Retail Sales numbers to gauge the strength of the dollar.

The dollar index recorded as rebounded from its liquidity zone suggests the index may have a short-term technical rebound. The RSI remains at the lower region while the MACD continues to edge lower, suggesting the overall bearish momentum remains strong.

Resistance level: 104.45, 104.75

Support level: 104.10, 103.70

Gold prices remain in an uptrend trajectory, but the bullish momentum appears to be easing. The precious metal is currently supported by heightened geopolitical events in the U.S. over the past weekend and is expected to stay buoyed around the $2400 level in the near term. However, the strengthening dollar may put pressure on gold prices.

Gold continues to trade within its bullish momentum; however, it is facing resistance at the below $2420 level. The RSI remains close to the overbought zone, while the MACD continues to edge higher, suggesting that the bullish momentum remains with gold.

Resistance level: 2430.00, 2450.00

Support level: 2388.00, 2368.00

The GBP/USD pair continues to strengthen, reaching its highest level in 2024, but it is currently facing selling pressure around the 1.3000 mark. The dollar is expected to strengthen further as the market reacts to the Trump gunshot incident, which may exert additional pressure on the pair. Meanwhile, the UK’s CPI, due on Wednesday, is anticipated to have a significant impact on the pair’s direction.

The GBP/USD continues to trade with strong uptrend momentum and is inch away from its psychological resistance level at 1.3000. The RSI remains in the overbought zone, while the MACD continues to edge higher, suggesting that the bullish momentum remains strong.

Resistance level: 1.3000, 1.3065

Support level: 1.2940, 1.2850

The EUR/USD pair traded close to its 2-month high, awaiting a catalyst to push it higher. The ECB is expected to hold its interest rate unchanged on 18th July, following its first rate cut last month. Meanwhile, the likelihood of a Fed rate cut has been increasing. This contrast in monetary policies between the central banks is fueling the uptrend momentum for the pair.

EUR/USD remains in the uptrend trajectory, and the bullish momentum remains strong. However, the pair is expected to face selling pressure at 1.0900. The RSI remains close to the overbought zone, while the MACD continues to edge higher, suggesting that the bullish momentum remains with the pair.

Resistance level: 1.0900, 1.0940

Support level: 1.0853, 1.0816

The U.S. tech-heavy index continues to face resistance as mega-tech stocks encounter selling pressure. However, the heightened optimism of a September Fed rate cut is expected to provide buoyancy for the equity market. The Trump-gunshot event over the weekend may impact market risk appetite and deter traders in the equity market.

The Nasdaq experienced a technical rebound at the Fibonacci retracement of 61.8%, suggesting the overall uptrend trajectory remains. The RSI has been fluctuating while the MACD is breaking below the zero line, suggesting the bearish momentum is gaining.

Resistance level: 20550.00, 20840.00

Support level: 20140.00, 20000.00

The New Zealand dollar has been lacklustre, trading sideways between the 0.6150 and 0.6080 levels over the past weeks. The Chinese GDP report, due today, may serve as a catalyst for the pair to pick a direction. Meanwhile, the New Zealand CPI reading is set for release on Wednesday. With expectations for a high reading, a CPI result that beats market consensus could strengthen the Kiwi, suggesting a potential hawkish monetary policy from the RBNZ.

The pair overall is trading with a lower-high price pattern suggesting a bearish bias for the pair. The RSI has been hovering near the 50 level while the MACD is breaking above the zero line, suggesting a neutral signal from both indicators.

Resistance level: 0.6150, 0.6210

Support level:0.6080, 0.6017

Oil prices faced strong selling pressure, being rejected once again below the $84.00 mark. U.S. consumer sentiment fell to an 8-month low in July, according to a survey conducted by the University of Michigan, which has weighed on oil prices. Oil traders are now looking at the upcoming Chinese GDP reading to gauge the future direction of oil prices.

Oil prices forming a lower high price pattern suggest a potential chance of trend reversal. The RSI is hovering near the 50 levels, while the MACD stays near the zero line, both giving a neutral signal for oil.

Resistance level: 84.20, 86.35

Support level:81.40, 79.70

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!