-

- 거래 조건

- 계좌유형

- 스프레드, 비용 & 스왑

- 입금 & 출금

- 수수료 & 요율

- 거래 시간

-

- 회사소개

- 회사개요

- PU Prime 리뷰

- 공지사항

- 뉴스룸

- PU Prime에 연락하기

- 고객센터

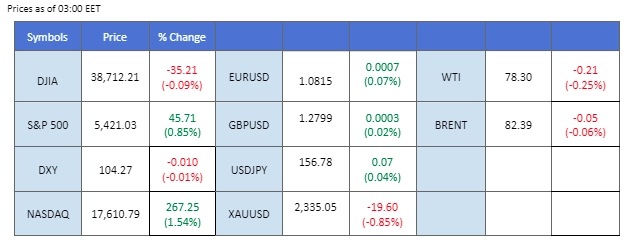

The financial markets experienced significant fluctuations in the last session, driven by two major economic events. Firstly, the U.S. CPI came in lower than market consensus, indicating easing inflation and boosting risk appetite. However, later in the session, the FOMC announced that there will be only one interest rate cut this year, reinforcing the Fed’s commitment to keeping borrowing costs high for longer to curb inflation. This hawkish stance caused the dollar index to rebound.

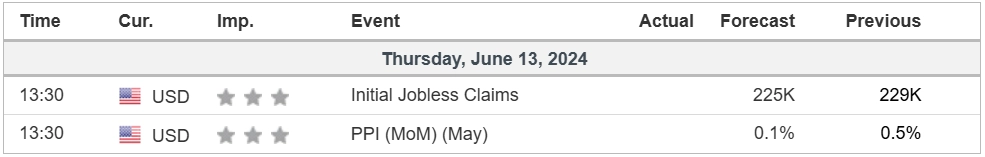

U.S. dollar traders are now focusing on today’s U.S. Initial Jobless Claims to gauge the dollar’s direction. Following the CPI reading, most currencies gained against the U.S. dollar, with the Pound Sterling and New Zealand dollar trading at recent highs. Additionally, Australian job data exceeded market expectations, showing higher employment changes and a slight improvement in the unemployment rate, which provided buoyancy for the Aussie dollar.

In the commodity markets, gold prices formed a false breakout pattern amid mixed economic signals, while oil prices edged lower due to a larger-than-expected crude stockpile build-up and the Fed’s hawkish monetary policy stance.

Current rate hike bets on 12nd June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (99.4%) VS -25 bps (0.6%)

(MT4 System Time)

Source: MQL5

The Dollar Index, which tracks the greenback against a basket of six major currencies, dipped aggressively following the Federal Open Market Committee (FOMC) meeting. Investors are digesting the dovish stance from the Federal Reserve, which held interest rates steady at 5.25% to 5.5% and revised its outlook for rate cuts in 2024. No members of the Monetary Policy Committee (MPC) voted to raise rates, citing concerns that continued restrictive policy could jeopardise economic growth. Additionally, Fed Chair Jerome Powell suggested that recent strong jobs data might be slightly “overstated,” indicating potential benchmark revisions.

The Dollar Index is trading lower while currently near the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 47, suggesting the index might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 105.10, 105.65

Support level: 104.45, 104.10

Gold prices rebounded sharply, initially buoyed by the depreciation of the US Dollar following the Federal Reserve’s dovish tones. US Treasury yields dipped further with rising expectations of rate cuts, adding to the bullish momentum for gold. However, investors subsequently took profits, leading to some retracement in gold prices. Despite the short-term bullish trend for gold, investors are advised to monitor strong resistance levels closely.

Gold prices are trading flat while currently near the support level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 49, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 2350.00, 2380.00

Support level: 2320.00, 2290.00

The GBP/USD pair surged sharply, reaching its highest level since March, but was subsequently rejected at the strong resistance level of 1.285. The initial surge was driven by a lower-than-expected U.S. CPI reading, which caused the dollar index to drop nearly 1%. However, the dollar later regained support following a hawkish statement from the Fed, which dampened the bullish momentum for the pair. This interplay of economic data and central bank signals highlights the volatile environment currently influencing the GBP/USD exchange rate.

The GBP/USD pair broke above its sideways trend and has formed a higher high, suggesting a bullish bias for the pair. The RSI has been gradually moving upward while the MACD has broken above the zero line and is diverging, suggesting the bullish momentum is gaining.

Resistance level: 1.2850, 1.2940

Support level:1.2760, 1.2660

The EUR/USD pair recorded a significant rebound from its one-month low, recovering from political uncertainty that had weighed on the euro in recent sessions. The pair surged as the dollar weakened following the release of softer-than-expected U.S. CPI data, which shifted market sentiment. Today, traders will be closely watching the U.S. Initial Jobless Claims and eurozone’s Industrial Production data, both of which are expected to influence the pair’s direction.

EUR/USD rebounded and has surpassed its resistance level at 1.0800, suggesting a potential trend reversal for the pair. The RSI surged sharply, while the MACD crossed and is moving toward the zero line from below, suggesting the bearish momentum is vanishing.

Resistance level: 1.0864, 1.0924

Support level: 1.0800, 1.0730

US equity markets continued to edge higher, buoyed by expectations of interest rate cuts in 2024, as indicated by Fed members. Recent data showing that inflation has cooled more than expected in May has stoked optimism that inflation in the US has stabilized, reducing the necessity for restrictive monetary policy. Meanwhile, the artificial intelligence hype remains strong in the market. The tech sector is in focus, with Oracle shares rising by 13% after the company announced new partnerships with ChatGPT-maker OpenAI and Google Cloud to extend its AI infrastructure.

Nasdaq is trading higher while currently near the resistance level. MACD has illustrated increasing bullish momentum.However, RSI is at 75, suggesting the index might enter overbought territory.

Resistance level: 19690.00, 20000.00

Support level: 18920.00, 18330.00

The NZD/USD pair experienced a significant jump in the last session, breaking through two resistance levels and indicating strong bullish momentum. The New Zealand dollar was bolstered by the Reserve Bank of New Zealand’s (RBNZ) hawkish stance, reflecting concerns over inflationary pressures in the country. However, the bullish momentum was tempered by the Federal Reserve’s hawkish stance, which provided some support to the U.S. dollar. As both central banks maintain a focus on combating inflation, the interplay between their respective policies will continue to influence the NZD/USD pair’s movement.

The NZD/USD pair has traded to its highest level in 2024, suggesting a bullish signal for the pair. The MADC has broken above the zero line and is diverging while the RSI has been surging, suggesting the bullish momentum is gaining.

Resistance level: 0.6200, 0.6255

Support level: 0.6150, 0.6100

Crude oil prices remained bullish, supported by expectations that global central banks might shift toward cutting interest rates, which would likely boost economic growth and enhance oil demand indirectly. Positive demand forecasts from the International Energy Agency (IEA) and the Organization of the Petroleum Exporting Countries (OPEC) have also bolstered the oil market’s outlook. However, gains in the oil market were limited by a downbeat inventories report. According to the Energy Information Administration (EIA), US crude oil inventories increased by 3.730 million barrels, significantly higher than market expectations of a 1.200-million-barrel drawdown.

Oil prices are trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 68, suggesting the commodity might experience technical correction since the RSI entered the overbought territory.

Resistance level: 79.80, 83.95

Support level: 76.15, 72.90

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!