PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

글로벌 시장을 한 손으로 거래하세요

우리의 거래 모바일 앱은 대부분의 모바일 기기와 호환됩니다. 지금 앱을 다운로드하고 언제 어디서나 인터넷이 있는 환경이라면 PU Prime과 거래를 시작하실 수 있습니다.

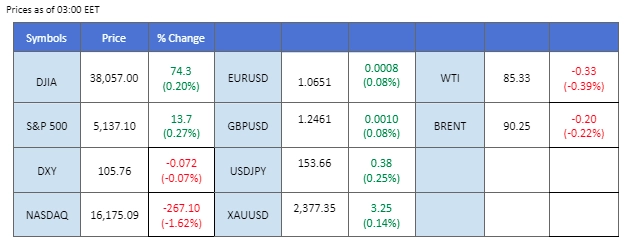

Gold surged past $2400 per troy ounce, hitting record highs driven by geopolitical tensions and global uncertainty before retracing as technical indicators signalled overheating, prompting profit-taking. Despite this, gold saw a remarkable 20% surge since mid-February, catching investors off guard amid talks of Federal Reserve interest rate cuts. Geopolitical tensions escalated as Iran launched a significant attack on Israel, utilising over 300 drones and missiles, driving up demand for safe-haven assets. The US Dollar strengthened on improved economic data, diminishing hopes of rate cuts, while oil prices consolidated around positive levels following Iran’s attack, with further gains dependent on Israel’s response and potential G7 actions targeting Iranian crude oil exports.

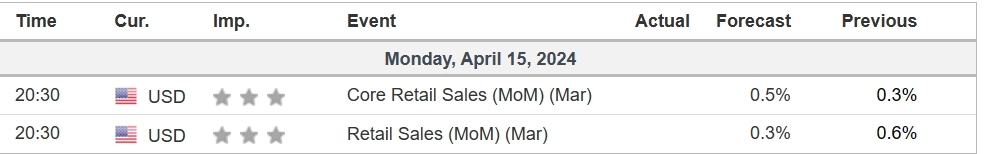

Current rate hike bets on 1st May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (97%) VS -25 bps (3%)

(MT4 System Time)

Source: MQL5

The US Dollar received further bullish momentum amidst improved economic data, diminishing hopes of Federal Reserve rate cuts. Better-than-expected indicators from the US region, coupled with a hawkish tone from Federal Reserve members, bolstered the currency’s strength amid weak global risk appetite.

The Dollar Index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 75, suggesting the index might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 106.00, 106.65

Support level: 105.40, 104.95

The gold market surged past the crucial $2400 per troy ounce mark, reaching record highs fueled by geopolitical tensions and global uncertainty. However, the rally lost steam as technical indicators signalled overheating, prompting investors to take profit and liquidate positions. Despite this retracement, gold has seen a remarkable 20% surge since mid-February, catching many investors off guard amid persistent talk of Federal Reserve interest rate cuts.

Gold prices are trading higher following the prior breakout above the previous resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 43, suggesting the commodity might extend its gains since the RSi

Resistance level: 2375.00, 2400.00

Support level: 2335.00, 2305.00

Despite upbeat factory data and the expected increase in monthly Gross Domestic Product (GDP) for February, the Pound Sterling failed to find traction amidst prevailing risk-off sentiment in global markets. The UK GDP expansion of 0.1% in line with expectations indicates a shallow recovery from the technical recession experienced in the second half of 2023. Attention now turns to monetary policy decisions from the Bank of England (BoE), with markets anticipating interest rate reductions starting from August.

GBP/USD is trading lower while currently testing the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 31, suggesting the pair might enter oversold territory.

Resistance level: 1.2530, 1.2610

Support level: 1.2435, 1.2320

Renewed geopolitical tensions over the weekend exerted pressure on the Euro as safe-haven demand for the Dollar intensified. Iran’s retaliatory actions against a suspected Israeli attack on its consulate in Syria kept markets on edge, despite relative calmness following advanced notice of the attack, which mitigated the risk of further escalation. Uncertainties linger, prompting a sell-off in riskier currencies, as investors monitor developments for trading signals.

EUR/USD is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 25, suggesting the pair might enter oversold territory.

Resistance level: 1.0710, 1.0765

Support level: 1.0645, 1.0555

The Japanese yen (JPY) continues its downward trajectory, reaching a fresh multi-decade low during Monday’s Asian session. The Bank of Japan’s (BoJ) dovish stance, signalling no urgency in policy normalisation, remains a key factor suppressing demand for the yen. Conversely, recent data from the US indicating robust economic growth contrasts with the BoJ’s position, widening the gap in US-Japan yield differentials and fueling bullish momentum on USD/JPY.

USD/JPY is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 66, suggesting the pair might extend its gains since the RSI stays above the midline.

Resistance level: 154.75, 156.80

Support level: 153.10, 151.95

US equity markets edged lower as sticky inflation and positive economic data reduced expectations of Federal Reserve interest rate cuts. Global risk aversion persisted, particularly heightened by escalating tensions in the Middle East following Iran’s attack on Israel, further dampening appetite for high-risk assets like equities.

The Dow is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 32, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 39150.00, 39855.00

Support level: 37700.00, 36560.00

Oil prices continued to consolidate around positive levels following Iran’s attack on Israel, with further gains contingent upon Israel’s response. The attack, marking a direct assault on Israeli territory, heightened fears of a wider regional conflict. Analysts anticipate potential spikes in oil prices depending on the severity of Israel’s reaction and any subsequent actions by the G7 targeting Iranian crude oil exports.

Oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 45, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 87.50, 90.90

Support level: 85.20, 83.05

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!