PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

글로벌 시장을 한 손으로 거래하세요

우리의 거래 모바일 앱은 대부분의 모바일 기기와 호환됩니다. 지금 앱을 다운로드하고 언제 어디서나 인터넷이 있는 환경이라면 PU Prime과 거래를 시작하실 수 있습니다.

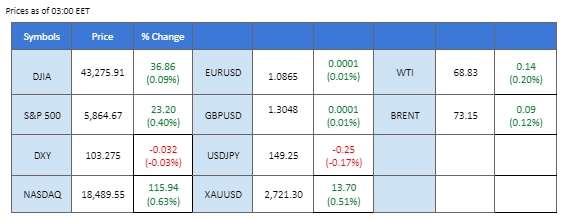

Market Summary

Gold surged to a record high, nearing the $2730 mark per ounce, as worsening tensions in the Middle East escalated. The situation intensified after a Hezbollah drone explosion near the Israeli Prime Minister’s private residence, prompting discussions of retaliation from Israel, which fueled the safe-haven demand for gold. Similarly, silver (XAGUSD) soared to its highest level in a decade, approaching the $34.00 mark, reflecting market uncertainty and geopolitical risk.

On the other hand, the U.S. stock market extended its rally last Friday, buoyed by earnings optimism despite earlier interruptions caused by robust U.S. economic data. However, with the U.S. presidential election drawing closer, market participants should brace for potential volatility.

In the cryptocurrency market, Bitcoin (BTC) surged towards the $70,000 mark on growing enthusiasm that both presidential candidates are seen as crypto-friendly, adding momentum to BTC’s upward trend.

In forex, the U.S. dollar eased slightly but remained on a bullish trajectory. Meanwhile, China-proxy currencies, including the Aussie and Kiwi, were boosted by China’s new economic stimulus package, including a central bank rate cut. Traders are also eyeing the Bank of Canada’s upcoming interest rate decision on Wednesday, where a 50 bps rate cut is expected, likely weakening the Canadian dollar further.

Current rate hike bets on 7th November Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (7%) VS -25 bps (93%)

(MT4 System Time)

N/A

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index, which trades against a basket of six major currencies, saw a slight pullback last week due to technical corrections and profit-taking. However, investor confidence in the U.S. dollar remains robust, driven by expectations that a Trump presidency could lead to policies beneficial for the dollar. Additionally, strong U.S. economic data has bolstered the positive outlook for the economy, maintaining demand for the dollar. This week’s economic calendar is relatively quiet, with the key event being the release of the Fed’s Beige Book on Wednesday, which could provide insight into the Fed’s future policy moves.

The Dollar Index is trading lower while currently near the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 67, suggesting the dollar might enter overbought territory.

Resistance level: 103.95, 104.95

Support level: 103.25, 102.50

Gold prices are trending higher as market volatility continues to shift investor sentiment toward safe-haven assets like gold. On the global front, the International Monetary Fund (IMF) warned last week that global public debt is expected to exceed $100 trillion by the end of this year, largely driven by the U.S. and China. Such high debt levels may trigger adverse market reactions and limit fiscal capacity to address future economic shocks. Meanwhile, with the U.S. presidential election fast approaching, ongoing volatility in the markets is sustaining gold’s appeal.

Gold prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 81, suggesting the commodity might enter overbought territory.

Resistance level: 2735.00, 2770.00

Support level: 2705.00, 2685.00

The GBP/USD pair held above its short-term resistance level at 1.3035, signalling a potential short-term trend reversal. However, the longer-term outlook for the Pound Sterling remains pressured. Last week’s softer-than-expected UK CPI reading suggested that the Bank of England (BoE) could be preparing for its first rate cut, which has weighed on the pound. While the pound briefly found support from an upbeat U.K. Retail Sales report, strong selling pressure may persist as the U.S. dollar remains resilient amid robust economic data and expectations of a hawkish Federal Reserve.

GBP/USD is currently supported above its previous resistance level, suggesting a bullish bias for the pair. If the pair is able to trade above its previous high at 1.3090, it may be a bullish signal. The RSI has been gaining, while the MACD is approaching the zero line from the bottom, suggesting the bearish momentum is easing.

Resistance level: 1.3075, 1.3140

Support level: 1.2980, 1.2910

The EUR/USD pair saw a slight rebound, primarily driven by a technical retracement in the U.S. dollar. However, the euro remains under pressure following the ECB’s interest rate cut last week, which has weakened the currency. In contrast, the dollar has been supported by strong U.S. economic data, reducing the likelihood of an aggressive rate cut by the Federal Reserve. With the U.S. presidential election approaching, market uncertainty will continue supporting the dollar, potentially adding further downside pressure on the EUR/USD pair.

EUR/USD has recorded a margin gain at its recent low level. The pair is expected to face significant selling pressure at below 1.0900 and may trigger a retracement near such a level. The RSI remains below 50, while the MACD hovers below the zero line, suggesting the pair remains trading with bearish momentum.

Resistance level: 1.0890, 1.0950

Support level: 1.0805, 1.0740

Rising U.S. Treasury yields have kept the U.S. equity market in a wait-and-see mode. Despite macroeconomic pressures, several companies posted better-than-expected financial results, offering support to the market. The S&P 500 and Nasdaq 100 remained mostly unchanged, while the Dow Jones Industrial Average gained 0.4%. Nvidia Corp. rose after an optimistic forecast from Taiwan Semiconductor Manufacturing Co. Meanwhile, Travelers Cos. increased by 9% following a profit jump to $1.3 billion. On the downside, Elevance Health Inc. fell 11% after cutting its annual forecast. Netflix Inc. rallied after beating subscriber growth estimates.

Nasdaq is trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 61, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 20415.00, 21075.00

Support level: 19705.00, 19120.00

The AUD/USD pair gained strength as the U.S. dollar experienced a technical retracement, pushing the pair above the critical 0.6700 level. The Australian dollar was further buoyed by China’s latest economic stimulus measures, including a reduction in lending rates, which positively impacted Chinese-proxy currencies like the Aussie. Additionally, last week’s robust Australian job data eased market expectations of a Reserve Bank of Australia (RBA) rate cut, further supporting the Aussie’s strength in the short term.

The pair is currently being supported at above 0.6700. If the pair is able to trade beyond 0.6740, it may be a bullish signal for the pair. The RSI has gotten above the 50 level, while the MACD is on the brink of breaking above the zero line, suggesting that the bearish momentum is diminishing.

Resistance level: 0.6730, 0.6785

Support level: 0.6670, 0.6615

Oil prices remain pressured after falling around 7% last week amid a gloomy demand outlook from top importer China and continued Middle East tensions. Brent crude settled more than 7% lower, while U.S. crude futures saw an 8% weekly drop, the biggest declines since early September. China’s third-quarter economic growth was the slowest since early 2023, although September’s consumption and industrial output figures were better than expected. However, China’s economic slowdown, coupled with the global shift towards electric vehicles, is likely to keep oil demand subdued.

Oil prices are trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 30, suggesting the commodity might enter oversold territory.

Resistance level: 72.55, 74.75

Support level: 69.85, 67.10

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!