PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

글로벌 시장을 한 손으로 거래하세요

우리의 거래 모바일 앱은 대부분의 모바일 기기와 호환됩니다. 지금 앱을 다운로드하고 언제 어디서나 인터넷이 있는 환경이라면 PU Prime과 거래를 시작하실 수 있습니다.

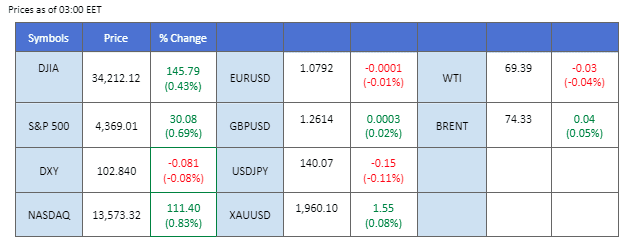

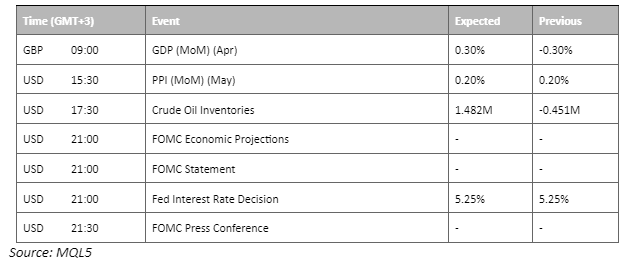

The equity markets experienced gains, accompanied by a weakening of the dollar, following the release of the U.S. Consumer Price Index (CPI) yesterday. The U.S. CPI decreased to 4% from the previous month’s 4.9%, potentially influencing the Federal Reserve’s decision on interest rate hikes, which is expected to be announced today (June 14th, 21:00). This economic data served as a positive development, complementing China’s decision to reduce its deposit rate, which contributed to a boost in oil prices. Elsewhere, New Zealand’s economy might have contracted for the second consecutive quarter according to economists polled by Reuters, raising the likelihood of a recession. Market expectations indicate that the Reserve Bank of New Zealand may halt its interest rate increases in light of this economic data, potentially resulting in a weakened New Zealand Dollar.

Current rate hike bets on 14th June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (96.5%) VS 25 bps (3.5%)

The US dollar, the world’s most influential currency, swiftly lost ground, slumping to a three-week low on the backdrop of the easing inflation report. The recent release of US inflation data has sent ripples through financial markets, with expectations now running high that the Federal Reserve will hit the pause button on its interest rate hikes. The Consumer Price Index, a key gauge of inflation, showed a meagre increase of just 0.10% for the month, resulting in a significant drop in the annual inflation rate to 4% from its previous reading of 4.90% in April.

The dollar index is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 40, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 103.65, 104.35

Support level: 103.00, 102.25

The release of US inflation data has had a profound impact on gold prices, leading to a significant surge at first reaction. Nonetheless, gold prices retracted back afterward as investors profit-taking on their positions while waiting for the results of the FOMC meeting. As the Consumer Price Index showed minimal growth, signalling a potential pause in the Federal Reserve’s interest rate hikes, the US dollar weakened in response.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 39, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 1980.00, 2005.00

Support level: 1940.00, 1915.00

The Euro continues to trade on its uptrend support level since early June. As the market started to anticipate a rate pause from the Fed, the dollar has gradually weakened from its peak at 104.65 to its current price level at 103.30. The U.S. CPI released last night further strengthened the belief that the Fed may pause its rate hike this round, given the CPI showed that the inflation is cooling in the country. On the other hand, the inflation remained high in the eurozone, prompting the ECB to continue raising its interest rate to reach its targeted inflation rate at 2%.

EUR/USD is trading in a bullish momentum as the price movement showed the pair traded in a higher-lower price pattern. The RSI is constantly hovering above 50-level while the MACD is flowing slightly flat, suggesting the bullish momentum is diminishing.

Resistance level: 1.0812, 1.0842

Support level: 1.0770, 1.0742

Despite the release of a disappointing inflation report in the US, the USD/JPY pair continues to trade with a positive trajectory as market participants eagerly await the upcoming central bank meetings in both countries. While it is widely anticipated that the Federal Reserve will keep interest rates unchanged, the key market determinant lies in the tone and outlook conveyed by policymakers.

USD/JPY is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 60, suggesting the pair might extend its gains since the RSI stays above the midline.

Resistance level: 141.70, 146.40

Support level: 137.65, 131.65

Sterling continues to be bullish against the USD, especially after the release of the U.S. CPI. The U.S. CPI data suggest that the chance for the Fed to pause its rate hike this round is higher as the inflation in the country seems under control. On the other hand, the U.K. ‘s inflation has remained high and prompted the BoE to continue in raising interest rates which will bolster the Sterling to trade higher. Investors may refer to the U.K. ‘s GDP data to gauge the price movement of the Sterling.

The cable constantly trades within its uptrend channel depicting the pair is trading in a bullish momentum. The decline in RSI as well as the MACD suggest that the bullish momentum for the pair is diminishing.

Resistance level: 1.2647, 1.2691

Support level: 1.2573, 1.2500

US equity benchmarks experienced an upswing, with Nasdaq soaring to their highest levels in 14 months. This surge in equity markets can be attributed to the easing inflation data, which directly impacted US Treasury yields. The Consumer Price Index, a key gauge of inflation, showed a meagre increase of just 0.10% for the month, resulting in a significant drop in the annual inflation rate to 4% from its previous reading of 4.90% in April. This represents the smallest 12-month increase in over two years, harkening back to March 2021.

Nasdaq is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 75, suggesting the index might enter overbought territory.

Resistance level: 15145.0, 15740.0

Support level: 14470.0, 13700.0

Oil prices staged a recovery, clawing back previous losses, propelled by renewed hopes for robust fuel demand in China. The surge in optimism followed a notable move by the country’s central bank, which slashed its short-term lending rate for the first time in 10 months. This unexpected decision is anticipated to stimulate economic activity and bolster China’s appetite for oil.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 47, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 70.70, 74.20

Support level: 67.20, 65.00

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!