PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

글로벌 시장을 한 손으로 거래하세요

우리의 거래 모바일 앱은 대부분의 모바일 기기와 호환됩니다. 지금 앱을 다운로드하고 언제 어디서나 인터넷이 있는 환경이라면 PU Prime과 거래를 시작하실 수 있습니다.

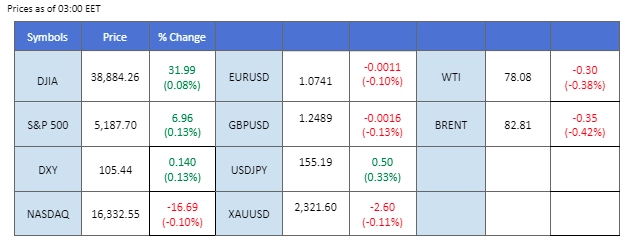

The latest session saw equity markets mainly focusing on earnings reports from prominent companies, maintaining a relatively steady position amidst a broader economic context. While last week’s softer-than-expected Nonfarm Payrolls (NFP) report temporarily influenced market sentiment, attention has shifted back to corporate performance as a key driver for stock movements.

On the currency front, the U.S. Dollar Index (DXY) has experienced a resurgence, presently holding above the 105 mark. This strength is supported by a hawkish tone from Federal Reserve officials, including comments from Fed’s Neel Kashkari. He highlighted persistent housing inflation and a robust job market as significant barriers to achieving the Fed’s 2% inflation target, despite some signs of inflation stalling.

Gold prices have faced downward pressure due to the strengthening dollar but remain above the $2300 mark. The resilience in gold prices reflects ongoing investor caution and the metal’s status as a hedge against inflation and currency devaluation. Oil markets are currently experiencing a tight trading range, hovering around $78 per barrel. The demand outlook remains uncertain, and although OPEC’s allies have reduced supply, this has been somewhat counterbalanced by higher-than-expected U.S. crude inventories.

In the UK, the British Pound has shown weakness ahead of the Bank of England’s (BoE) upcoming interest rate decision and monetary policy statement. Investors and traders in GBP are closely watching for insights from the BoE that could indicate future monetary policy directions and implications for the strength of the Sterling.

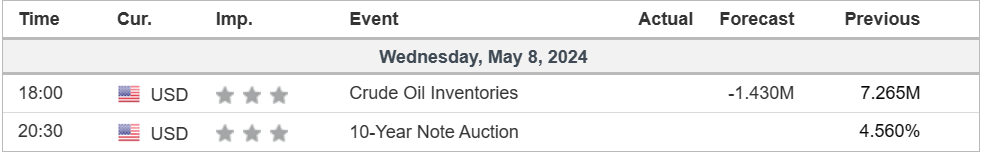

Current rate hike bets on 12nd June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (91.6%) VS -25 bps (8.4%)

(MT4 System Time)

Source: MQL5

The Dollar Index witnessed a notable resurgence, propelled by the discernment of Federal Reserve officials’ latest commentary on interest rate trajectories. With a more hawkish stance emerging among key Fed members, including Minneapolis Federal Reserve President Neel Kashkari, who emphasised a potential prolonged period of steady or elevated borrowing costs amidst lingering inflationary pressures, market sentiment pivoted towards dollar strength.

The Dollar Index is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 58, suggesting the index might extend its gains toward resistance level since the RSI stays above the midline.

Resistance level: 105.70, 106.35

Support level: 105.05, 104.60

Gold prices retreated slightly as the appeal for the U.S. Dollar strengthened following hawkish signals from Federal Reserve officials. This was compounded by increased global risk appetite fueled by positive trade relations, diminishing the allure of safe-haven assets like gold. However, ongoing geopolitical uncertainties, particularly regarding Middle East ceasefire negotiations, suggest that gold’s retreat may be temporary, with the potential for a resurgence if tensions escalate, highlighting the complex interplay between monetary policy, trade dynamics, and geopolitical events in shaping gold’s trajectory.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 38, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 2330.00, 2350.00

Support level: 2305.00, 2290.00

The GBP/USD pair is currently navigating a bearish trajectory, with market attention squarely focused on the imminent Bank of England (BoE) interest rate decision scheduled for tomorrow, May 9th. This downward movement is primarily attributed to the dollar’s resurgence, propelled by concerns voiced by Federal Reserve officials regarding the potential stickiness of inflation. GBP traders are closely monitoring developments surrounding the BoE’s monetary policy statement, seeking insights that may shed light on the future direction of Sterling.

The GBP/USD is trading downward, approaching its short-term support level at 1.2480. The RSI has been edging lower, while the MACD has crossed above and is declining toward the zero line, suggesting that the bearish momentum is overwhelming.

Resistance level: 1.2660, 1.2760

Support level: 1.2440, 1.2370

The EUR/USD pair has experienced a slight downturn after consolidating near its recent highs, indicating a potential bearish sentiment for the pair. Initially, the euro received a boost from positive retail sales figures, reflecting ongoing economic strength in the region. However, the pair faced pressure following hawkish remarks from Federal Reserve officials regarding persistent inflationary pressures in the United States, causing it to dip below its consolidation range.

The pair has broken below the price consolidation range, suggesting a bearish bias for the pair. The MACD has crossed and edged lower from the above while the RSI has eased from near the overbought zone, suggesting the pair has eased in bullish momentum.

Resistance level: 1.0775, 1.0865

Support level: 1.0700, 1.0630

U.S. equity markets maintained their upward trajectory, buoyed by a prevailing risk-on sentiment. Global investor confidence remained robust, fueled by optimistic expectations surrounding trade relations, particularly with China and other major economies. Attention centred on President Xi Jinping’s diplomatic visit to Europe, with market participants eagerly anticipating potential synergies that could affect the global economic landscape.

Dow Jones is trading higher while currently near the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 63, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 39145.00, 39855.00

Support level: 37690.00, 36550.00

The USD/CHF pair has broken out from an ascending triangle pattern, reinforcing a bullish outlook. The pair’s upward trajectory continues to be driven by the robust performance of the U.S. dollar, which has managed to overshadow positive economic indicators from Switzerland. Despite Switzerland posting higher-than-expected Consumer Price Index (CPI) figures last week and a slightly improved unemployment rate reported yesterday, these positive developments have not been sufficient to counterbalance the prevailing strength of the U.S. dollar.

USD/CHF has rebounded from its recent low and broken above its resistance level at 0.9080, suggesting a bullish bias for the pair. The RSI is edging up, while the MACD has crossed below and is heading toward the zero line, suggesting bullish momentum is forming.

Resistance level: 0.9145, 0.9200

Support level: 0.9038, 0.9000

Crude oil prices experienced early declines in Asian trading, prompted by a bearish oil inventory report revealing a significant uptick in U.S. crude oil inventories, contrary to market expectations. Moreover, the prospect of ceasefire talks in the Middle East further weighed on oil prices. Amidst efforts to broker a Gaza ceasefire, U.S. Central Intelligence Agency Director Bill Burns’ impending discussions with Israeli Prime Minister Benjamin Netanyahu underscored geopolitical dynamics influencing commodity markets.

Oil prices are trading lower while currently testing the support level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 39, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 80.40, 81.90

Support level: 78.00, 75.95

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!