PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

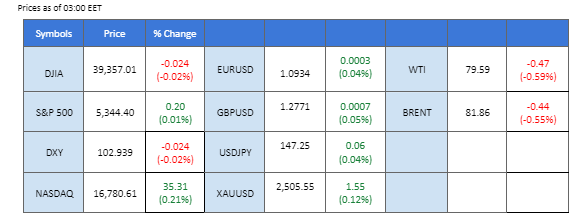

Gold prices experienced their largest gain in three weeks, driven by escalating tensions in the Middle East and the easing of the U.S. dollar as markets await the crucial CPI reading due on Wednesday. Gold has surged to an all-time high above $2,460, as uncertainties surrounding developments in both the Middle East and Eastern Europe persist push the demand for safe-haven assets higher.

Commodity currencies, including the New Zealand and Australian dollars, showed strong performance among their peers. The upcoming RBNZ interest rate decision on Wednesday and Australia’s job data release on Thursday are expected to be key catalysts for further gains in these currencies. Meanwhile, the easing of concerns around the Japanese yen carry trade has provided support to the stock market, with Wall Street posting marginal gains yesterday, and Asian markets recovering most of their losses from the previous week.

Current rate hike bets on 18th September Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (88.5%) VS -25 bps (11.5%)

(MT4 System Time)

Source: MQL5

DOLLAR_INDX, H4

The Dollar Index remained flat as market participants await key economic reports, including the US Producer Price Index (PPI), which is due on Tuesday. The PPI is expected to provide insights into the Federal Reserve’s outlook on interest rates. A higher-than-expected PPI could reduce the likelihood of rate cuts and limit the downside for the USD.

The Dollar Index is trading flat while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 48, suggesting the index might trade lower since the RSI stays below the midline.

Resistance level: 103.35, 104.05

Support level: 102.40, 101.40

The rising geopolitical tensions have significantly increased demand for safe-haven assets like gold. Gold prices continue to surge as investors seek protection from the escalating conflict in the Middle East. The possibility of Federal Reserve rate cuts and the ongoing tensions in the region remain key drivers of bullish momentum in the gold market.

Gold prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 67, suggesting the commodity might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 2465.00, 2485.00

Support level: 2425.00, 2380.00

The Pound Sterling remained in a narrow trading range against the U.S. dollar, with both currencies lacking significant catalysts in the recent session. However, the UK job data, due later today, and the CPI readings from both countries set for release tomorrow, could prove pivotal for the pair. Currently, the pair is hovering near its weekly high, facing resistance at the 1.2780 level. A break above this resistance could signal a bullish shift.

GBP/USD is trading sideways with the sign of breaking its current resistance level at 1.2780. The RSI has been flowing above the 50 level, while the MACD has broken above the zero line, suggesting the bullish momentum is building.

Resistance level: 1.2850, 1.2910

Support level: 1.2700, 1.2630

The EUR/USD pair posted a marginal gain in the last session, currently testing its resistance at the 1.0940 level. The easing strength of the U.S. dollar, influenced by a decline in U.S. Treasury yields, has provided support for the pair, allowing it to reach its weekly high. Euro traders will be closely watching tomorrow’s GDP release, which is expected to show signs of economic improvement. A positive GDP report could propel the pair to break through its current resistance.

The EUR/USD pair is poised at its recent high level, awaiting the catalyst to break above its current resistance level. The RSI has been hovering close to the overbought zone, while the MACD has signs of rebounding from above the zero line, suggesting bullish momentum is forming.

Resistance level: 1.0985, 1.1040

Support level: 1.0895, 1.0850

The NZD/USD pair has formed an ascending triangle and a higher-high price pattern, signaling a bullish bias. Last week’s upbeat job data has heightened market expectations for a hawkish stance from the RBNZ, whose interest rate decision is due tomorrow. If these expectations are met, it could further fuel the pair’s upward momentum.

The pais is traded relatively flat in the recent session at its recent high levels. The RSI flowing flat at above the 50 level while the MACD flowing flat at the elevated level suggest the bullish momentum remains intact with the pair.

Resistance level: 0.6080, 0.6150

Support level: 0.5965, 0.5910

The USD/JPY pair remains at its recent high level, despite the U.S. dollar’s recent easing. Last month’s BoJ interest rate hike caused turmoil in global financial markets, prompting the Japanese central bank to maintain a cautious, hawkish stance until market volatility subsides. Reports of Japan’s parliament holding a special session on the BoJ rate hike add to the uncertainty, which is weighing on the strength of the Japanese yen.

The pair is hold up at its next resistance level at near 147.65 level. The RSI has improved from the oversold zone while the MACD has broken above the zero line suggesting the bullish momentum is forming. Should the pair be able to break above from such a level, it will be a bullish signal for the pair.

Resistance level: 148.65, 150.00

Support level: 145.20, 142.25

US equity markets extended their gains, supported by falling US Treasury yields ahead of the release of several crucial economic reports. However, despite the recent gains, momentum in the equity markets remains sluggish as investors adopt a wait-and-see approach until more economic data, particularly inflation reports, are released. Investors are advised to continue monitoring these reports closely to gain further trading signals.

Dow Jones is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 45, suggesting the index might extend ist gains since the RSI rebounded sharply from oversold territory.

Resistance level: 39900.00, 40525.00

Support level: 39135.00, 38565.00

Crude oil prices have rebounded sharply due to the worsening situation in the Middle East. Concerns over potential supply disruptions have intensified as market participants brace for possible retaliatory actions by Iran. If Iran launches an attack, there is a possibility that the US may implement stricter oil sanctions against Iran, further exacerbating fears of supply shortages and driving oil prices higher.

Oil prices are trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 77, suggesting the commodity might enter overbought territory.

Resistance level: 80.90, 83.55

Support level: 78.55, 75.40

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!