PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

글로벌 시장을 한 손으로 거래하세요

우리의 거래 모바일 앱은 대부분의 모바일 기기와 호환됩니다. 지금 앱을 다운로드하고 언제 어디서나 인터넷이 있는 환경이라면 PU Prime과 거래를 시작하실 수 있습니다.

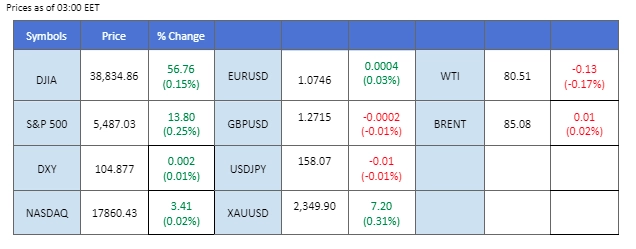

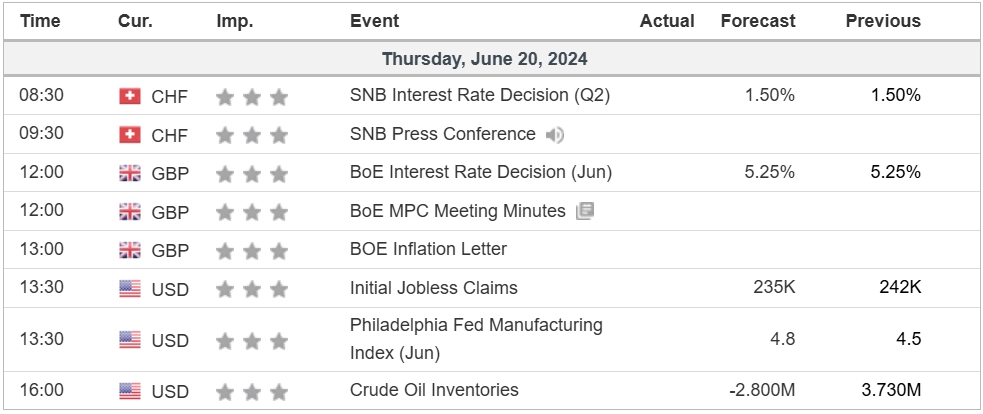

The financial market remained relatively quiet as the U.S. celebrated its National Independence Day holiday yesterday, resulting in a halt for the U.S. equity market. However, the equity market futures remained bullish, catalysed by the tech sector. Attention now turns to the Pound Sterling as the Bank of England’s (BoE) interest rate decision is due later today. The UK’s Consumer Price Index (CPI), released yesterday, hit the central bank’s target rate of 2%, leading to speculation about a potential shift in BoE’s monetary policy.

In the commodity market, gold prices maintained their high levels from yesterday as the dollar eased over the past few sessions. Conversely, oil prices dropped significantly from their bullish trend as optimism about demand outlook waned. Oil traders are now focusing on today’s crude oil inventory data to gauge the future direction of oil prices.

Current rate hike bets on 31st July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (91.7%) VS -25 bps (8.3%)

(MT4 System Time)

Source: MQL5

The Dollar Index, which measures the greenback against a basket of six major currencies, remained flat due to the US holidays and a lack of significant market catalysts from the US region. The long-term outlook for the dollar remains bearish, influenced by a series of downbeat US economic indicators. However, uncertainties persist ahead of key economic reports and Federal Reserve statements due later today. Investors are particularly focused on the US Initial Jobless Claims and the Philadelphia Fed Manufacturing Index for further trading signals.

The Dollar Index is trading lower while currently near the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 49, suggesting the index might remain flat as the RSI stays near the midline.

Resistance level: 105.65, 106.35

Support level: 105.15, 104.45

The gold market also remained flat due to the absence of market catalysts from the US and the impact of the US holidays. Despite the current stagnation, the pessimistic outlook for the US economy could signal a positive trend for gold. Investors are advised to monitor upcoming US economic data closely to better gauge potential movements in the gold market. The release of crucial data later today will be pivotal in confirming gold’s trajectory amid economic uncertainties.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 58, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 2330.00, 2360.00

Support level: 2295.00, 2265.00

The Pound Sterling remained stable after the release of UK CPI data that matched market expectations. The inflation data supported the case for waiting a few more weeks to determine the direction of price pressures. While UK inflation slowed to the Bank of England’s 2% target for the first time in almost three years in May, service sector price growth remains nearly three times higher. Investors and analysts expect the Bank of England to maintain the benchmark rate at a 16-year high of 5.25%. Nonetheless, attention will be on future statements from Governor Andrew Bailey and his colleagues for insights into potential interest rate decisions.

GBP/USD is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 50, suggesting the pair might be traded in a range since the RSI stays near the midline.

Resistance level: 1.2740, 1.2795

Support level: 1.2685, 1.2645

The EUR/USD pair traded in a tight range near the 1.0740 level as the U.S. market was halted due to the national holiday, and the euro lacked catalysts to drive price action. However, traders should pay attention to today’s U.S. Initial Jobless Claims, as a weaker-than-expected job data could exert further downside pressure on the dollar. Additionally, euro traders are anticipating the PMI readings due tomorrow, which could potentially act as a catalyst to spur the euro.

EUR/USD was trading flat for the past session, giving a neutral signal for the pair. The RSI has been moving upward while the MACD is on the brink of breaking above the zero line, suggesting the bullish momentum may be forming.

Resistance level: 1.0805, 1.0860

Support level: 1.0660, 1.0615

The Hong Kong equity market surged nearly 2% yesterday, marking a three-day winning streak and suggesting a potential trend reversal for the index. The bullish sentiment is primarily driven by growing optimism about more market-friendly measures from regulators. Additionally, reports indicate that the Chinese sovereign fund is buying into the Hong Kong market, further boosting investor confidence.

The Hong Kong market has found support at the above 17800 level and has jumped by more than 3% from its recent low level, suggesting a potential trend reversal for the index. The RSI is on the brink of breaking into the overbought zone, while the MACD has broken above the zero line and is further diverging, suggesting that bullish momentum is gaining.

Resistance level: 18,900.00, 19.300.00

Support level: 17,950.00, 17,520.00

The Japanese Yen continued to slide despite hawkish statements from Bank of Japan (BoJ) officials, indicating a potential rate hike in July. The USD/JPY pair has once again traded above the 158.00 level, prompting traders to be cautious about a possible intervention from Japanese authorities. The Japanese CPI readings are due tomorrow and may have a direct impact on the Yen’s performance.

USD/JPY has formed an ascending triangle pattern; a break from above suggests a solid bullish signal for the pair. The RSI has been flowing in the upper region while the MACD is hovering flat above the zero line, suggesting the pair remains trading with bullish momentum.

Resistance level: 158.45, 159.50

Support level: 157.20, 156.15

Oil prices steadied as the market awaited the release of weekly US inventory data, which may indicate another increase in nationwide crude inventories. Despite the current stability, oil remains bullish for a monthly gain following OPEC+ extending supply cuts and raising the forecast for oil demand. Major energy agencies have recently revised their oil balance projections for this year and next, with UBS noting that the crude market is expected to tighten in the second half of 2024. Investors should continue to monitor inventory data and supply forecasts to assess future price movements.

Oil prices are trading lower while currently near the support level. MACD has illustrated increasing bearish momentum, while RSI is at 64, suggesting the commodity might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 81.65, 84.35

Support level: 78.55, 77.15

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!