PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

글로벌 시장을 한 손으로 거래하세요

우리의 거래 모바일 앱은 대부분의 모바일 기기와 호환됩니다. 지금 앱을 다운로드하고 언제 어디서나 인터넷이 있는 환경이라면 PU Prime과 거래를 시작하실 수 있습니다.

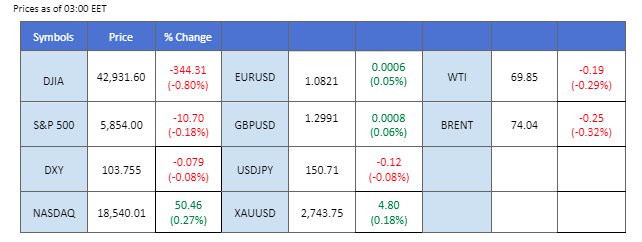

Market Summary

Safe-haven gold continues to trade within a bullish trajectory as traders closely watch developments in the Middle East. With the U.S. presidential election looming, demand for gold has surged due to the uncertainty surrounding the event. Meanwhile, silver has exhibited extreme bullish momentum, rising nearly 7% last week and holding at its highest levels in a decade in recent sessions.

In contrast, oil prices remain subdued as a pessimistic demand outlook weighs on the commodity. The Dollar Index (DXY) rose to a new high in the latest session, driven by extended sell-offs in the bond market, pushing U.S. Treasury yields higher. If Donald Trump wins the presidential election, concerns over his policies potentially stoking higher inflation could lead the Fed to maintain elevated interest rates.

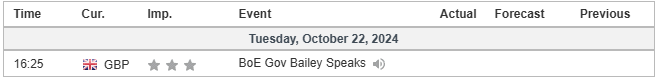

In the forex market, the Bank of Canada’s interest rate decision is due tomorrow, with a 50 basis point rate cut expected. If realised, it could further weaken the Canadian dollar against its peers.

Current rate hike bets on 7th November Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (7%) VS -25 bps (93%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The dollar climbed on Monday, buoyed by a rise in U.S. bond yields, as solid U.S. economic data suggested the Federal Reserve can afford to be patient in cutting rates. Investors are positioning for the Nov. 5 presidential election. The greenback has risen for three straight weeks and in 14 of the past 16 sessions, as a run of positive economic data led investors to scale back expectations about the size and speed of rate cuts from the Fed. Markets are pricing in an 87% chance of a 25-bps cut at the Fed’s November meeting.

The Dollar Index is trading lower while currently near the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 67, suggesting the dollar might enter overbought territory.

Resistance level: 103.95, 104.95

Support level: 103.25, 102.50

As the U.S. election approaches, investors are continuing to price in safe-haven assets, including the dollar and gold. However, gains in the gold market paused as investors decided to take profit. In the long term, Middle East tensions and uncertainty around the U.S. presidential election increased flows toward safe-haven assets over the last five trading days.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 58, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 2735.00, 2770.00

Support level: 2705.00, 2685.00

The GBP/USD pair has formed a double-bottom price pattern near the 1.2978 level, indicating the possibility of a technical rebound. However, the pair remains under strong selling pressure as the U.S. dollar continues to strengthen ahead of the U.S. presidential election and ongoing tensions in the Middle East. If the pair manages to break above the 1.3080 level, it could signal a potential trend reversal for the pound, though until then, the bearish bias persists. Traders should watch for any significant developments that could shift market sentiment.

GBP/USD seems to have found support and formed a double-bottom price pattern at the 1.2975 mark. The RSI remains close to the oversold zone, but the MACD is edging higher, suggesting the pair is still trading with bearish momentum. A break below the support level suggests a solid bearish signal for the pair.

Resistance level: 1.3075, 1.3140

Support level: 1.2910, 1.2850

The European Central Bank (ECB) cut rates for the third time this year, causing the euro to weaken compared to the dollar. Slovak central bank chief Peter Kazimir indicated that eurozone inflation is likely to return to target next year, but more evidence is needed. Monday’s data showed German producer prices fell more than expected due to declining energy costs, prompting investors to sell euros and shift toward the dollar.

EUR/USD is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 33, suggesting the pair might enter oversold territory.

Resistance level: 1.0890, 1.0950

Support level: 1.0805, 1.0740

The Nasdaq has formed an ascending triangle price pattern, which typically signals a potential bullish breakout if the index breaks above the upper boundary of the pattern. The tech-heavy index remains within its bullish trajectory, supported by market optimism around mega-cap earnings and the potential for another round of AI-driven rallies. However, uncertainties such as the ongoing Middle East tensions and the upcoming U.S. presidential election could act as hindrances, limiting the Nasdaq’s upward momentum in the near term.

Nasdaq is trading higher, but the bullish momentum seems to have eased in recent sessions. The RSI remains above the 50 level, while the MACD has a lower-high pattern, suggesting that the bullish momentum is easing.

Resistance level: 21075.00, 22040.00

Support level: 19705.00, 19120.00

The USD/JPY pair has been trading steadily within its uptrend channel over the past 10 sessions, indicating a continued bullish bias. This upward momentum is driven by the combination of uncertainty around the BoJ’s upcoming monetary policy and the robust performance of the U.S. dollar. The release of the BoJ Core CPI reading later today is expected to have a direct influence on the pair’s direction, as a higher-than-expected reading could prompt speculation on tighter monetary measures, while a softer reading may further weaken the yen and fuel the pair’s uptrend.

The pair continues its bullish rally and is trading to its 10-week high, suggesting a bullish bias for the pair. The RSI remains close to the overbought zone, while the MACD is edging lower, suggesting that the bullish momentum is easing.

Resistance level: 152.25, 153.85

Support level: 149.40, 147.30

Oil prices rebounded slightly on bargain buying and technical corrections, despite ongoing tensions in the Middle East. Pessimistic demand outlooks, especially from China, continued to weigh on oil prices. U.S. Secretary of State Antony Blinken is pushing for a ceasefire in the Gaza war to prevent the conflict from spilling over into Lebanon. Meanwhile, China’s slow economic growth and its shift toward electric vehicles are expected to reduce oil demand in 2025.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 45, suggesting the commodity might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 69.90, 72.60

Support level: 67.10, 65.55

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!