-

- 거래 조건

- 계좌유형

- 스프레드, 비용 & 스왑

- 입금 & 출금

- 수수료 & 요율

- 거래 시간

-

- 회사소개

- 회사개요

- PU Prime 리뷰

- 공지사항

- 뉴스룸

- PU Prime에 연락하기

- 고객센터

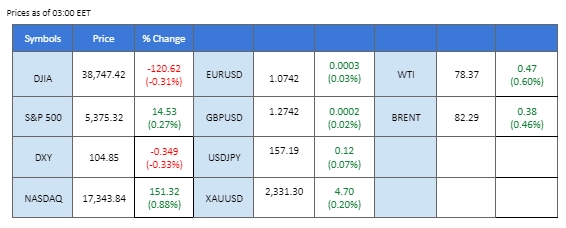

The dollar index steadied in the last session, trading above the $105 mark, ahead of the highly anticipated FOMC meeting minutes. Market expectations are leaning towards a more hawkish stance from the U.S. central bank due to a tight labour market. Analysts predict that the Fed is likely to implement two 25 bps rate cuts toward the end of the year, contingent on further evidence that inflation is slowing.

Meanwhile, the Japanese yen seesawed against the U.S. dollar, with the pair trading at the critical 157 mark. Japan’s wholesale inflation jumped to 2%, its highest level since last September, complicating the Bank of Japan’s interest rate decision due on Friday.

In the commodity market, gold prices eked out marginal gains, remaining subdued near the $2300 level. Oil prices were encouraged by an upbeat U.S. weekly crude report and optimistic projections from the OPEC+ monthly report, suggesting that oil demand will pick up later in the year.

Current rate hike bets on 12nd June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (99.4%) VS -25 bps (0.6%)

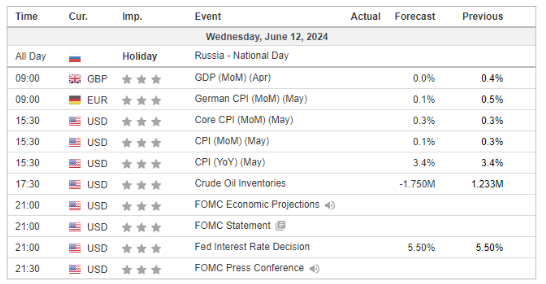

(MT4 System Time)

Source: MQL5

DOLLAR_INDX, H4

The Dollar Index, which measures the greenback against a basket of six major currencies, remained flat ahead of several crucial economic data releases and events later this week. Investors are closely monitoring the upcoming US CPI report and the Federal Reserve’s interest rate decision for further trading signals. Economists expect consumer price inflation to decrease to 0.10% from 0.30% last month, with core price pressures holding steady at 0.30%. Despite recent underwhelming economic performance from the US, the latest Nonfarm Payrolls report has complicated the economic outlook. Clients should be aware of potential significant movements in the Dollar and gold following these events.

The Dollar Index is trading flat while currently hovering around the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 65, suggesting the index might trade lower if it successfully breaks below the support level since the RSI retreated from overbought territory.

Resistance level: 105.65, 106.35

Support level: 105.10, 104.45

Gold prices slightly rebounded, remaining within a consolidation range as investors shifted their portfolios toward safe-haven assets ahead of several crucial economic events. Uncertainties persist regarding the gold market trend, with investors advised to await the upcoming US CPI data and the Federal Reserve meeting to gauge future movements. These events are likely to provide clearer direction for the gold market.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 45, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 2320.00, 2350.00

Support level: 2290.00, 2260.00

The GBP/USD pair traded sideways at its crucial support level ahead of the upcoming FOMC interest rate decision. Last Friday’s strong U.S. Nonfarm Payroll (NFP) report led the market to anticipate a more hawkish stance from the U.S. central bank, potentially exerting further downside pressure on the pair. Meanwhile, the UK’s job data released yesterday was mixed, but the upbeat average earnings growth rate suggests that the Bank of England (BoE) may maintain its current monetary tightening policy for an extended period.

The GBP/USD pair seems to have found support after experiencing a technical retracement. The RSI is gradually moving up, while the MACD has crossed below the zero line, suggesting a potential trend reversal signal for the pair.

Resistance level: 1.2760, 1.2850

Support level:1.2660, 1.2540

The EUR/USD pair continues to trade in a lackluster manner as the euro faces political headwinds. However, the pair finds support at the strong 1.0730 level. Meanwhile, all eyes are on the upcoming FOMC interest rate decision and CPI reading, which could potentially fuel the strength of the dollar and exert further pressure on the pair. The euro’s performance is being closely watched, with these critical economic indicators likely to influence its direction in the near term.

EUR/USD remains subdued but are currently traded at its crucial support level and could potentially experience a technical rebound. The RSI has gotten out from the oversold zone, while the MACD is crossing below the zero line, suggesting that the bearish momentum is vanishing.

Resistance level: 1.0805, 1.0864

Support level: 1.0730, 1.0630

The Nasdaq continued to climb to a record close for the second consecutive day, driven by falling Treasury yields and a surge in Apple shares to an all-time high. The ongoing hype around artificial intelligence remains a strong catalyst for global investors. Apple shares rose 7%, hitting a record high after the company announced its AI strategy. Apple unveiled a partnership with OpenAI to integrate the ChatGPT chatbot into its products, aiming to enhance its AI capabilities and drive the next iPhone upgrade cycle.

Nasdaq is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 70, suggesting the index might enter overbought territory.

Resistance level: 19690.00, 20000.00

Support level: 18920.00, 18330.00

The AUD/USD pair ticked higher following its significant plummet last Friday, driven by the strengthened U.S. dollar in response to robust Nonfarm Payroll (NFP) data. The pair’s movement is expected to be influenced by today’s U.S. CPI release and the upcoming FOMC interest rate decision. Meanwhile, Aussie traders are closely monitoring tomorrow’s Australian job data, which could be crucial for the Reserve Bank of Australia’s (RBA) interest rate decision due next week.

The AUD/USD edge higher from its support level suggests a potential trend reversal for the pair. The RSI has rebounded from the oversold zone, while the MACD is crossing below the zero line, suggesting that the bearish momentum is vanishing.

Resistance level: 0.6640, 0.6680

Support level: 0.6585, 0.6540

Crude oil prices edged higher on upbeat global demand forecasts from the US Energy Information Administration (EIA) and OPEC+. The EIA recently raised its 2024 world demand growth forecast to 1.10 million barrels per day, up from the previous estimate of 900,000 bpd. OPEC maintained its 2024 forecast for strong global oil demand growth, citing expectations for increased travel and tourism in the second half of the year. Despite recent downbeat economic performances from the US, the optimistic forecasts from OPEC and the EIA have bolstered investor confidence in oil prices.

Oil prices are trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 68, suggesting the commodity might experience technical correction since the RSI entered the overbought territory.

Resistance level: 79.80, 83.95

Support level: 76.15, 72.90

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!