PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

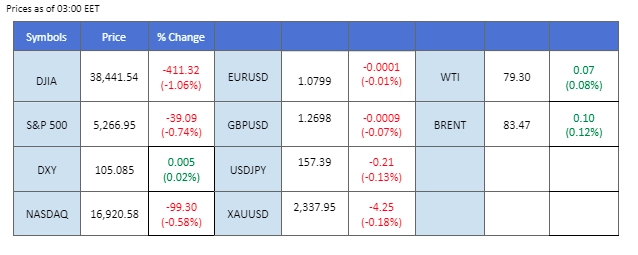

The U.S. 7-year note auction held yesterday saw tepid demand for long-term Treasury yields, resulting in a decline in bond prices and pushing bond yields higher. This development, combined with market perception that the Federal Reserve is not planning to initiate a rate cut policy soon, fueled risk-averse sentiment and hammered equity markets. The dollar index (DXY) as a result rose nearly 0.5% in the last session.

In the forex market, the Japanese yen traded above the 157 mark, prompting market speculation of potential official intervention by Japanese authorities. Yen traders are advised to exercise extra caution.

In commodities, gold prices were negatively impacted by the strengthening dollar, declining towards recent low levels at the 2330 mark. Despite U.S. weekly crude data showing a significant decline of 6.490 million barrels in crude stockpiles, the strengthening dollar and the perception of a high-interest-rate environment overshadowed the positive reading, driving oil prices lower.

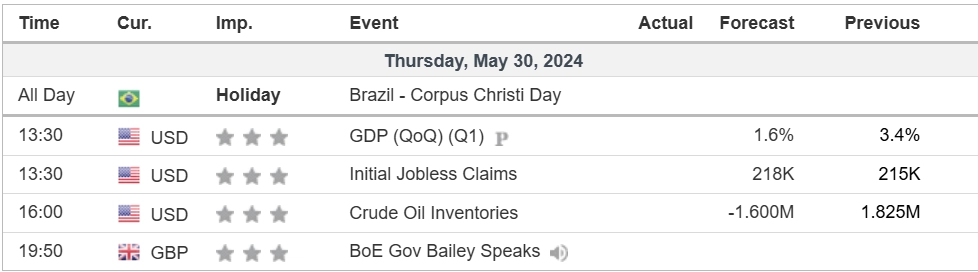

Current rate hike bets on 12th June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (99.1%) VS -25 bps (0.9%)

(MT4 System Time)

Source: MQL5

The Dollar Index, which tracks the greenback against a basket of six major currencies, extended its gains amid rising US Treasury yields, as market participants anticipate key inflation data. Despite the lack of recent economic catalysts, US 10-year Treasury yields have reached their highest level in nearly four weeks, supported by strong consumer confidence. Investors are advised to monitor several crucial US economic reports, including GDP figures, initial jobless claims, and the Fed’s preferred inflation gauge, the US Core PCE Price Index, for further trading signals.

The Dollar Index is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 69, suggesting the index might enter overbought territory.

Resistance level: 105.15, 105.55

Support level: 104.40, 104.00

Gold prices retreated as a stronger US Dollar and rising US Treasury yields prompted profit-taking among investors. The recent weaker demand in US bond auctions suggests that institutional investors expect the Fed to maintain higher interest rates for an extended period, further pressuring gold prices. However, this movement in gold might be short-term, as long-term trends remain uncertain. Investors are advised to await further clarity from upcoming US economic data before making significant market entries.

Gold prices are trading lower while currently testing the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 36, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 2365.00, 2395.00

Support level: 2335.00, 2305.00

The GBP/USD pair faced significant downward pressure in the last session, driven by a strengthened U.S. dollar. The pair is heading toward its lowest level in a week. Yesterday’s tepid demand for U.S. long-term Treasury notes, combined with hawkish statements from Federal Reserve officials this week, fueled the dollar to trade at its 2-week high. Traders are now eyeing today’s U.S. GDP report to gauge the strength of the dollar and its implications for the GBP/USD pair.

GBP/USD declined to its one-week low after touching its highest level since March. The RSI is heading into the oversold zone, while the MACD is on the brink of breaking below the zero line, suggesting a bearish momentum is forming.

Resistance level: 1.2760, 1.2850

Support level: 1.2660, 1.2600

The EUR/USD pair is trading with strong bearish momentum, reaching its 2-week low. The euro continues to face headwinds from a potential shift in ECB monetary policy, while the strengthening U.S. dollar has exerted additional pressure on the pair. Traders are eyeing today’s U.S. GDP report and tomorrow’s PCE data to gauge the direction of the pair. The outcomes of these economic indicators will be crucial in determining the pair’s near-term trajectory.

The EUR/USD pair is currently trading with strong bearish momentum and has broken below its support level at 1.0800. The RSI is on the brink of breaking into the oversold zone, while the MACD has broken below the zero line, suggesting a bearish signal for the pair.

Resistance level: 1.0865, 1.0920

Support level: 1.0735, 1.0650

The USD/JPY has once again traded above the critical level of 157, prompting market speculation about potential intervention from Japanese authorities. The pair previously experienced sharp declines when approaching the 158 mark in April, suggesting heightened vigilance among traders. As the pair nears these sensitive levels, traders should remain cautious of potential intervention from Japanese authorities to stabilise the yen.

The pair has edged higher and traded to its highest level in May. The RSI remains flowing closely toward the overbought zone, while the MACD shows signs of rebounding from above the zero line, suggesting the pair remains trading with bullish momentum.

Resistance level: 157.90, 159.50

Support level: 156.60, 155.00

The Dow Jones Industrial Average edged sharply lower, pressured by rising US Treasury yields and significant declines in airline stocks. American Airlines’ announcement to cut its second-quarter profit guidance led to a more than 13% drop in its shares, significantly impacting the index. Additionally, US Treasury yields climbed following a series of weaker-than-expected bond auction results, indicating decreased demand for bonds, which in turn lifted yields. Investor sentiment remains cautious ahead of the US Core PCE Price Index release, prompting a selloff in higher-risk assets such as equities.

Dow Jones is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum. However, RSI is at 28, suggesting the index might enter oversold territory.

Resistance level: 38565.00, 39135.00

Support level: 37810.00, 37160.00

Crude oil prices dipped ahead of the OPEC+ meeting later this week, driven by a stronger US Dollar. The dollar-denominated oil faced downward pressure, but the losses were limited by positive inventory data. The American Petroleum Institute (API) reported a sharper-than-expected decline in US crude stockpiles last week, indicating a pickup in energy demand as the summer driving season begins. Investors will focus on the upcoming inventory report from the Energy Information Administration (EIA) and the OPEC+ meeting for further trading signals.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 54, suggesting the commodity might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 80.20, 82.00

Support level: 76.90, 75.55

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!