-

- 거래 조건

- 계좌유형

- 스프레드, 비용 & 스왑

- 입금 & 출금

- 수수료 & 요율

- 거래 시간

-

- 회사소개

- 회사개요

- PU Prime 리뷰

- 공지사항

- 뉴스룸

- PU Prime에 연락하기

- 고객센터

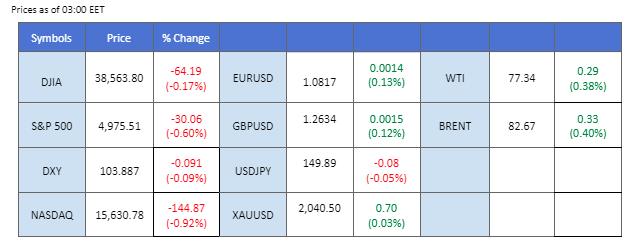

As the FOMC January meeting minutes loom, the Dollar Index (DXY) is losing steam, struggling to maintain its value above $104.

As the Federal Open Market Committee (FOMC) January meeting minutes loom, the Dollar Index (DXY) is losing steam, struggling to maintain its value above $104. Conversely, gold prices are surging due to the softened dollar, breaking above the strong resistance level at $2020. The heightened tension in the Red Sea, where Houthi militants forced the crew to abandon a vessel, underscores ongoing risks in the region, boosting the safe-haven asset, gold. The situation in the Red Sea may also impact oil prices; adding to that, the latest OPEC+ report indicates that Russia met its target for export cuts in January, complying with the early pledge to the cartel, buoying oil prices.

In the equity markets, all U.S. indexes edged lower, with Nvidia leading the chart with a 4.35% decline. The chip-maker’s earnings report, expected later today, is anticipated to influence the equity market. Additionally, Australia’s Q4 wage growth met market expectations, coming in at 0.9%, resulting in annual wage growth reaching a 15-year high due to low unemployment rates and stiff competition in the country. This situation may prompt the Reserve Bank of Australia (RBA) to exercise extra caution in making decisions on monetary policy, and the robust job market in Australia may bolster the strength of the Australian dollar.

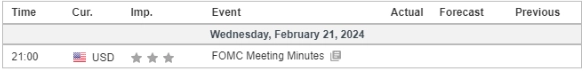

Current rate hike bets on 20th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (89.5%) VS -25 bps (10.5%)

(MT4 System Time)

Source: MQL5

The US Dollar experienced a pullback as investors engaged in profit-taking strategies in anticipation of the release of the FOMC meeting minutes. Eyes are now firmly set on insights from the late-January meeting, where the central bank’s decision to maintain rates and concerns about persistent inflation set the stage for potential market impact. The nuanced discussions and comments from Fed members are poised to take centre stage, influencing global investor sentiment.

The Dollar Index is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 39, suggesting the index might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 104.60, 105.70

Support level: 103.85, 103.05

Gold prices tread water around the psychological level of $2025 as global investors await the FOMC meeting minutes before committing to the gold market. Despite concerns about higher-for-longer US rates, gold managed to rebound after testing the $2000 support level. The overall trend for gold remains mixed, with rising geopolitical tensions in the Middle East supporting safe-haven demand, while hawkish expectations from the Federal Reserve weigh on the appeal of dollar-denominated gold.

Gold prices are trading higher following the prior breakout above the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 62, suggesting the commodity might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 2035.00, 2060.00

Support level: 2015.00, 1985.00

The Pound Sterling is making attempts to break through its price consolidation range around 1.2635 levels. BoE Governor Andrew Bailey expresses optimism about the UK economic outlook, highlighting the strength of the labour market. However, the BoE chief did not delve into discussions regarding the timing and quantity of future rate cuts, although market speculation suggests it may occur in June. All eyes are now on the Federal Open Market Committee (FOMC) meeting minutes scheduled for later today, which could directly influence the GBP/USD pair.

GBP/USD surged and is currently hovering near its resistance level at 1.2635. The RSI has been gradually moving up while the MACD has crossed above the zero line, suggesting the bullish momentum is building up.

Resistance level: 1.2710, 1.2785

Support level:1.2530, 1.2440

The EUR/USD pair saw upward movement in the last session, benefitting from a softened U.S. dollar, and is currently testing its downtrend resistance level. Concurrently, the Euro’s Consumer Price Index (CPI) is scheduled for release tomorrow, with expectations indicating signs of easing. If the reading aligns with market expectations, it could potentially impede the bullish run of the euro against the USD.

EUR/USD had a technical rebound but is currently hindered by its long-term downtrend resistance level. The RSI has risen to near the overbought level, and the MACD has broken above the zero line, suggesting the bullish momentum is continuously gaining.

Resistance level: 1.0865, 1.0954

Support level: 1.0775, 1.0770

The US equity market retreated, weighed by Nvidia’s disappointing financial results, which sent the tech sector lower. Ahead of the FOMC meeting, uncertainty prevails as the Federal Reserve’s tone could spark volatility. Notably, Walmart’s positive fourth-quarter US sales and earnings results provided a counterbalance, limiting losses in the equity market.

Nasdaq is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 46, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 18150.00, 19255.00

Support level: 17280.00, 16670.00

China’s unexpected decision to slash its five-year loan prime rate (LPR) by 25 basis points, the largest cut since its introduction in 2019, exceeded analysts’ expectations. The move raises optimism for additional stimulus measures, potentially stimulating Chinese economic growth. This sentiment lift reverberates in the performance of Chinese-proxy currencies, with the antipodeans (New Zealand Dollar and Australian Dollar) benefiting due to their strong trade ties with China.

NZD/USD is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 67, suggesting the pair might extend its gains toward resistance level since the RSI stays above the midline.

Resistance level: 0.6210, 0.6260

Support level: 0.6145, 0.6080

Crude oil prices experienced a retreat, failing to break above a strong resistance level, largely attributed to a technical correction. Geopolitical uncertainties persist, particularly with the unresolved ceasefire between Hamas and Israel. This ambiguity contributes to concerns about potential supply disruptions. On the flip side, the Chinese central bank’s rate cut aims to boost economic momentum, potentially leading to increased oil demand if the positive economic trajectory continues.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 47, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 78.65, 81.20

Support level: 75.20, 71.35

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!