PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

글로벌 시장을 한 손으로 거래하세요

우리의 거래 모바일 앱은 대부분의 모바일 기기와 호환됩니다. 지금 앱을 다운로드하고 언제 어디서나 인터넷이 있는 환경이라면 PU Prime과 거래를 시작하실 수 있습니다.

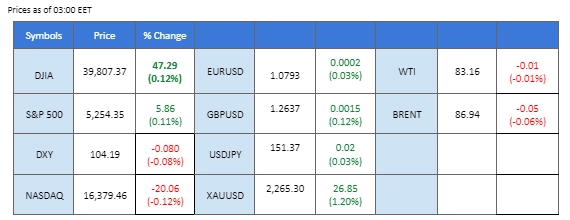

The Dollar Index extended its upward trend, buoyed by hawkish remarks from Federal Reserve officials and robust inflation figures, including the Personal Consumption Expenditures (PCE) Price Index hitting 2.5% annually. Concurrently, safe-haven gold surged to record highs amidst subdued market sentiment, although concerns lingered regarding the Federal Reserve’s inflation-fighting stance. Attention now turns to forthcoming US employment data, with forecasts predicting a slower job growth rate in March. Oil prices rose on alleviated global supply surplus worries, supported by reduced Russian output and ongoing production cuts from OPEC. Meanwhile, the Japanese yen held steady amidst warnings of potential intervention, with Prime Minister Kishida signalling readiness to address excessive currency market movements. However, bearish economic data tempered yen gains, particularly amid expectations of a slowdown in core inflation in Tokyo

Current rate hike bets on 1st May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (85.5%) VS -25 bps (14.5%)

(MT4 System Time)

Source: MQL5

The Dollar Index continued its upward trajectory against a basket of major currencies during this holiday trading session, bolstered by hawkish comments from Federal Reserve members and robust inflation data. Fed Governor Christopher Waller’s assertion that recent disappointing inflation figures support the case for maintaining current interest rates further reinforced the dollar’s strength. Despite the Personal Consumption Expenditures (PCE) Price Index ticking slightly higher to 2.5% annually in February, in line with market expectations, concerns about inflation lingered.

The Dollar Index is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 59, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 104.60, 104.95

Support level:104.00, 103.65

Despite the strengthening US Dollar, safe-haven gold maintained its bullish momentum, fueled by dampened risk appetite ahead of significant events. The precious metal surged to all-time highs, marking a fifth consecutive session of gains. However, investors remain cautious as the Federal Reserve’s stance on combating inflation could potentially impact gold’s appeal. Monitoring further developments and potential shifts in Fed rhetoric will be crucial for traders seeking trading signals.

Gold prices are trading higher following the prior breakout above the previous resistance level. MACD has illustrated diminishing bearish momentum. However, RSI is at 84, suggesting the commodity might enter overbought territory.

Resistance level: 2250.00, 2280.00

Support level: 2215.00, 2185.00

Pound Sterling maintained a neutral stance, hovering around strong support levels amid market closures for holidays. Meanwhile, the US Dollar continued its ascent fueled by better-than-expected economic data, reducing expectations for Federal Reserve rate cuts. Conversely, the Bank of England (BoE) signalled intentions to implement three quarter-point rate reductions in 2024, weighing on the Pound Sterling. Economic indicators comparing the US and UK economies suggest the UK slipped into recession in the latter part of 2023, adding pressure on the currency.

GBP/USD is trading flat, while currently testing the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 49, suggesting the pair might be traded lower after breakout since the RSI stays below the midline.

Resistance level: 1.2710, 1.2770

Support level: 1.2610, 1.2530

The EUR/USD pair faced downward pressure as the strengthening US Dollar contrasted with expectations for a more dovish stance from the European Central Bank (ECB). ECB Governing Council member Yannis Stournaras hinted at the possibility of four interest rate cuts totaling 100 basis points in 2024, diverging from market expectations for three rate cuts from the Federal Reserve. The disparity in central bank policies underscored concerns about the euro’s appeal against the greenback amidst diverging economic outlooks.

EUR/USD is trading lower while currently testing the support level. However, MACD has illustrated increasing bullish momentum, while RSI is at 40, suggesting the pair might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 1.0865, 1.0960

Support level: 1.0770, 1.0710

The Australian dollar saw a modest rebound amidst thin trading sessions following the release of encouraging economic data from China. China’s official Manufacturing Purchasing Managers’ Index (PMI) surged to 50.8 in March, surpassing expectations and indicating an expansion in manufacturing activity. Similarly, the Non-Manufacturing PMI rose to 53.3, further bolstering sentiment. As China remains a key trading partner for Australia, the positive economic performance in the region lifted prospects for the Aussie dollar, despite lingering long-term concerns.

AUD/USD is trading higher, while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 48, suggesting the pair might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 0.6535, 0.6585

Support level: 0.6485, 0.6410

The Japanese yen maintained its position amidst authorities’ warnings of potential currency intervention. Japanese Prime Minister Fumio Kishida emphasised the government’s readiness to address excessive currency market movements, signalling potential Bank of Japan intervention if deemed necessary. However, the yen’s gains were tempered by bearish economic data, with expectations of a slowdown in core inflation in Japan’s capital city, Tokyo, further impacting sentiment.

USD/JPY is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 50, suggesting the pair might be trading flat since the RSI near the midline.

Resistance level: 151.95, 153.10

Support level: 150.80, 149.35

US equity market futures continued to climb higher, driven by optimism surrounding trends in artificial intelligence (AI) and expectations of Federal Reserve interest rate cuts. The demand for tech sector stocks remained robust, buoyed by investor confidence in AI advancements. Anticipated Fed rate reductions, particularly in the wake of the Core PCE Index aligning with market expectations, further fueled market optimism. The resultant drop in US Treasury yields contributed to the bullish sentiment in equity futures trading.

Dow Jones is trading higher, while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 66, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 39855.00, 40995.00

Support level: 39825.00, 39150.00

Oil prices edged higher as concerns about a global supply surplus eased, supported by lower Russian output and ongoing production curbs by major oil-producing nations. Russia’s decision to deepen production cuts and the reduction in fuel supplies following attacks on Russian fuel refineries by Ukraine contributed to market optimism. Investors await cues from the upcoming meeting of the Joint Monitoring Ministerial Committee of OPEC amid ongoing geopolitical risks.

Oil prices are trading higher, while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 73, suggesting the commodity might enter overbought territory.

Resistance level: 83.15, 85.45

Support level: 80.20, 78.00

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!