PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

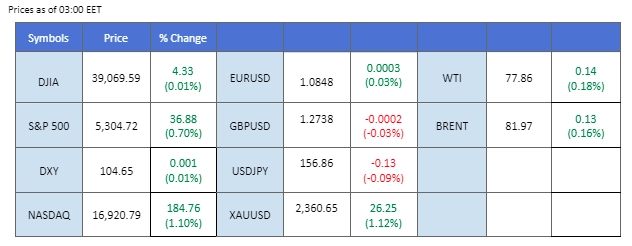

The Dollar Index dipped as investors took profits ahead of key economic data and events later this week, including the Fed’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) price index. With US markets closed for a holiday, trading in dollar-related products is expected to be subdued. Investors are also eyeing speeches from several Fed officials for potential insights into future interest rate decisions.

Gold prices remained steady amid the US holiday, reflecting subdued trading activity. Last week’s significant selloff in gold was driven by hawkish Fed statements and rising US Treasury yields. This week, investors are advised to monitor key US economic data, particularly the PCE price index and Fed speeches, for indications of future trends in the gold market.

Crude oil prices rebounded slightly on Friday but posted weekly losses due to concerns about the impact of robust US economic data and hawkish Fed expectations on oil demand. Traders are looking forward to the June 2nd OPEC+ meeting, where discussions will focus on extending voluntary production cuts.

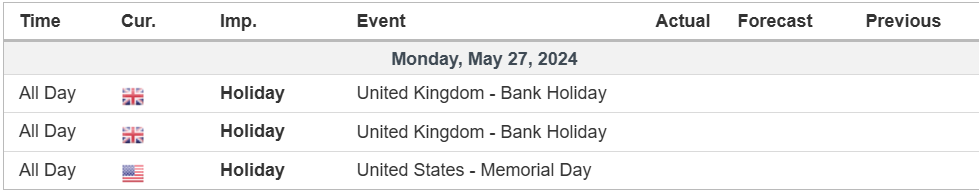

Current rate hike bets on 12nd June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98.8%) VS -25 bps (1.2%)

(MT4 System Time)

Source: MQL5

The Dollar Index, which measures the greenback against a basket of six major currencies, dipped as investors took profits ahead of several high-volatility events later this week. With US markets closed for a holiday, trading in dollar-related products is expected to be subdued. Investors are closely watching the Fed’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) price index, due on Friday, for insights into future interest rate decisions. Additionally, several Fed officials are scheduled to speak this week, potentially providing further market-moving information.

The Dollar Index is trading lower while currently near the support level. MACD has illustrated increasing bearish momentum, while RSI is at 47, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 105.25, 105.70

Support level: 104.65, 103.90

Gold prices remained flat, reflecting subdued trading activity due to the US holiday. Last week, gold experienced a significant selloff driven by hawkish Fed statements and rising US Treasury yields. This week, investors are advised to monitor key US economic data and events, particularly the PCE price index and Fed speeches, for indications of future trends in the gold market.

Gold prices are trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 33, suggesting the commodity might enter oversold territory.

Resistance level: 2365.00, 2395.00

Support level: 2335.00, 2285.00

The Pound Sterling remains near its two-month peak against the U.S. dollar, even though the latest U.K. retail sales figures fell short of market expectations. U.K. retail sales dropped by 2.7%, indicating a contraction in the economy. However, the retracement of the U.S. dollar last Friday has helped the GBP/USD pair maintain its elevated levels. Adding to the dynamics, the U.S. Treasury is set to implement a buyback program for U.S. treasuries. This move is anticipated to hinder treasury yields, potentially putting additional pressure on the U.S. dollar and providing further support for the GBP/USD pair.

GBP/USD is trading below its strong resistance level at near 1.2760, awaiting a catalyst to break above. The RSI remains elevated, while the MACD shows signs of rebounding above the zero line, suggesting fresh bullish momentum may be forming.

Resistance level: 1.2760, 1.2850

Support level: 1.2660, 1.2600

The EUR/USD pair defied expectations, staying above the key psychological support level of 1.0800. This suggests continued bullish momentum for the euro. However, recent economic data from the Eurozone has cast doubt on the European Central Bank’s (ECB) commitment to further monetary tightening. This could limit the euro’s upside potential. Market participants are now looking for signs of a potential policy pivot by the ECB away from its current hawkish stance.

EUR/USD has formed a lower high pattern, suggesting that bullish momentum is easing. The RSI is gradually moving lower, while the MACD has broken below the zero line, suggesting that bullish momentum is vanishing.

Resistance level: 1.0865, 1.0920

Support level: 1.0805, 1.0730

The Japanese Yen remains under pressure as investors await Tokyo inflation data due on Friday. Market participants are keen to gauge when the Bank of Japan might consider raising interest rates. The Yen has suffered from widening interest rate differentials, and a surprise spike in inflation or a shift in BoJ policy could trigger significant market movements. Investors should exercise caution and closely monitor developments for potential monetary policy shifts.

USD/JPY is trading higher following the prior break above resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 57, suggesting the pair might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 157.90, 159.45

Support level: 156.55, 155.05

The NZD/USD pair has been stuck in a consolidation pattern for the past week, hovering around the 0.6135 resistance level. This sideways price action comes despite ongoing high inflation in New Zealand, which would typically support the Kiwi dollar. However, market focus has shifted towards the possibility of the Federal Reserve enacting a rate cut later this year. This anticipation is weighing on the NZD/USD, as a potential rate cut in the US could weaken the dollar and limit the upside potential of the Kiwi.

The pair has once again traded to its recent high level but has been rejected at near its recent peak level for the past four times. The MACD is flowing flat close to the zero line, while the RSI is hovering near the 50 level, which gives a neutral signal for the pair.

Resistance level: 0.6150, 0.6205

Support level: 0.6100, 0.6050

Crude oil prices saw a slight rebound on Friday but posted weekly losses amid concerns that robust US economic data and hawkish Fed expectations could dampen oil demand. The Fed’s latest meeting minutes revealed policymakers questioning if current rates are high enough to curb persistent inflation, suggesting potential economic slowdowns. However, losses in the oil market were tempered as traders await the June 2nd OPEC+ meeting, where the group will discuss extending voluntary production cuts of 2.2 million barrels per day. Market participants are closely watching for any signals from the producer group.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 51, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 79.85, 82.00

Support level: 76.90, 75.55

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!