PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

글로벌 시장을 한 손으로 거래하세요

우리의 거래 모바일 앱은 대부분의 모바일 기기와 호환됩니다. 지금 앱을 다운로드하고 언제 어디서나 인터넷이 있는 환경이라면 PU Prime과 거래를 시작하실 수 있습니다.

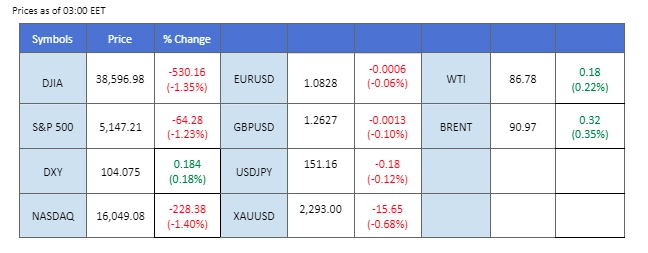

The dollar index (DXY) briefly dipped below the pivotal $104 mark before rebounding in anticipation of the upcoming release of the Non-Farm Payrolls (NFP) report, introducing an element of volatility into the market. Recent positive economic indicators, particularly the ADP non-farm employment change figures, exceeding expectations, have buoyed market sentiment surrounding the US currency. Investors are now cautiously optimistic about the potential for the forthcoming NFP data to outperform consensus forecasts.

In response, DXY found support above the $104 threshold, mitigating its initial decline, while equity markets grappled with shifting sentiment. Meanwhile, Bank of Japan (BoJ) Governor Haruhiko Kuroda’s remarks hinting at potential future interest rate hikes and his emphasis on monitoring foreign exchange rate movements resonated positively with the Japanese yen, driving it to a three-week high against the dollar.

Turning to commodities, gold prices experienced a technical retracement following recent highs, indicative of a temporary pause in their upward trajectory. Conversely, oil prices continued their upward climb, fueled by mounting tensions between Israel and Iran. The prospect of geopolitical instability disrupting oil supplies from the region has contributed to the bullish sentiment in the oil market.

Current rate hike bets on 1st May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (85.5%) VS -25 bps (14.5%)

(MT4 System Time)

Source: MQL5

The Dollar Index, a gauge of the greenback’s strength against major currencies, continued its downward trend, impacted by a disappointing US jobs report. The Department of Labor revealed an unexpected rise in Initial Jobless Claims from 212K to 221K, missing market expectations. This development could significantly influence expectations for upcoming key data releases such as Nonfarm Payrolls and Unemployment Rate figures.

The Dollar Index is trading lower while currently near the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 40, suggesting the index might experience technical correction since the RSI rebound sharply from oversold territory.

Resistance level: 104.60, 104.95

Support level:104.00, 103.65

Despite a slight slowdown in bullish momentum, gold prices maintained near-record levels as global investors treated cautiously ahead of key economic data releases. Geopolitical tensions in regions like the Middle East and ongoing crises in Russia and Ukraine, coupled with a recent earthquake in Taiwan, continued to drive safe-haven demand for gold, further supported by a weakening US Dollar.

Gold prices are trading flat while currently testing the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 46, suggesting the commodity might trade lower since the RSI stays below the midline.

Resistance level: 2290.00, 2305.00

Support level: 2280.00, 2260.00

The GBP/USD pair faced resistance at the 1.2660 level and subsequently retraced as a result. Fundamentally, the UK’s PMI readings released yesterday fell short of expectations, contributing to downward pressure on the Sterling. Meanwhile, optimism surrounding the US Non-Farm Payrolls (NFP) report scheduled for release later today bolstered the strength of the dollar.

GBP/USD has eased in bullish momentum from its strong rebound in previous sessions. The RSI failed to break into the overbought zone while the MACD ease after breaking above the zero line suggest the bullish momentum is easing.

Resistance level: 1.2660, 1.2760

Support level: 1.2540, 1.2440

The EUR/USD pair experienced a retracement from its recent bullish rally, encountering resistance at the 1.0866 level in the last session. The Euro may have been affected by CPI readings released on Wednesday, indicating that the ECB’s targeted inflation rate is within reach and suggesting the adoption of a rate reduction policy in the near future. Additionally, the strengthening dollar ahead of today’s Non-Farm Payrolls (NFP) report exerted pressure on the euro.

EUR/USD recorded a technical retracement but remained in its bullish trajectory. The MACD remained above the zero line, while the RSI flowed in the upper region, suggesting that the pair’s bullish momentum remained intact.

Resistance level: 1.0866, 1.0954

Support level: 1.0775, 1.0700

The USD/JPY pair broke below its weeks-long consolidation range, indicating a bearish bias for the pair. Yesterday, the Bank of Japan (BoJ) chief held his first press conference following the country’s first rate hike since 2007. He hinted at the possibility of another rate hike later this year if conditions permit, and reiterated that the central bank has been closely monitoring exchange rate movements in the market, suggesting potential intervention if necessary. Despite the strengthening dollar, the pair managed to trade at its lowest level in three weeks.

The USD/JPY pair has broken below its consolidation range after a bearish divergence, suggesting a bearish bias for the pair. The RSI has dropped below the 50 level, while the MACD hovers closely to the zero line, suggesting a bearish momentum is forming.

Resistance level: 151.85, 153.20

Support level: 149.50, 147.60

The Dow Jones Industrial Average faced its fourth consecutive day of losses, grappling with geopolitical tensions and cautious remarks from Federal Reserve officials. The impending release of the monthly jobs report added to market jitters, prompting investors to reassess their positions. Key tech giants like Apple, Amazon, Microsoft, and Meta Platforms Inc. relinquished earlier gains, reflecting broader market concerns despite positive sentiments from certain quarters.

Dow Jones is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 41, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 39150.00, 39855.00

Support level: 37700.00, 36560.00

Crude oil prices experienced a significant surge propelled by concerns over lower supply amidst decisions by major producers, including OPEC+, to maintain output cuts. Growing signs of economic strength in China also contributed to heightened demand for oil, underscoring the market’s focus on supply dynamics amid geopolitical tensions and supply disruption fears.

Oil prices are trading higher following the prior breakout above previous resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 79, suggesting the commodity might enter overbought territory.

Resistance level: 87.90, 89.10

Support level: 83.75, 83.15

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!