PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

글로벌 시장을 한 손으로 거래하세요

우리의 거래 모바일 앱은 대부분의 모바일 기기와 호환됩니다. 지금 앱을 다운로드하고 언제 어디서나 인터넷이 있는 환경이라면 PU Prime과 거래를 시작하실 수 있습니다.

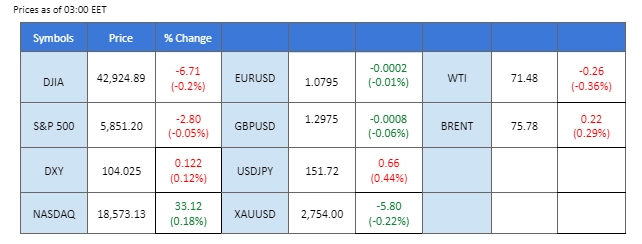

Market Summary

The U.S. dollar has continued to strengthen against major currencies, supported by a sharp rise in long-term Treasury yields, which have reached their highest level since July. The market appears to be pricing in a soft landing by the Federal Reserve, particularly as the U.S. presidential election nears. Investors are preparing for the possibility of sticky inflationary pressures in the post-election period, keeping the dollar buoyant.

On the other hand, the ECB is shifting its focus, as policymakers express concerns about inflation falling well below the central bank’s 2% target. This has fueled speculation about a more growth-oriented monetary policy approach, sending a dovish signal that has led the euro to suffer its fourth straight week of losses against the dollar.

In the commodity market, gold prices have surged to a new record high near the $2,750 mark, driven by bullish sentiment in the safe-haven market amidst global uncertainty. Oil prices also saw a strong rally, with WTI crude rising over 2%, breaking the $70.00 level, suggesting a potential turnaround for the energy sector.

In the crypto market, both Bitcoin (BTC) and Ethereum (ETH) have stabilised after sliding from their recent highs, and there is potential for a technical rebound if optimism remains intact in the lead-up to the U.S. election.

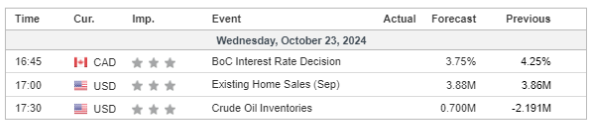

Current rate hike bets on 7th November Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (7%) VS -25 bps (93%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The U.S. dollar rose to a fresh 2-1/2-month high, continuing its recent ascent as expectations that the Federal Reserve will temper its interest rate cut path strengthened. Investors are also positioning ahead of the U.S. presidential election, which appears to be tightly contested. The greenback has risen for three straight weeks and is on track for its 15th gain in 17 sessions, driven by positive economic data that has pushed U.S. Treasury yields higher.

The Dollar Index is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 73, suggesting the index might enter overbought territory.

Resistance level: 104.95, 105.55

Support level: 103.95, 103.25

The fundamentals for the gold market remain unchanged, supported by rising Middle East tensions and uncertainty surrounding the U.S. election. Market participants are concerned that a Donald Trump win could trigger further tariffs, increasing market volatility and supporting gold prices. Gold is expected to benefit from continued safe-haven demand in the near term.

Gold prices are trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 68, suggesting the commodity might enter overbought territory.

Resistance level: 2735.00, 2770.00

Support level: 2705.00, 2685.00

The GBP/USD pair has extended its slide, hitting a new low in recent sessions. However, the pair’s bearish momentum is easing, and traders are starting to anticipate a potential trend reversal in the near term. The pair remains under pressure due to the dollar’s strength, which has been bolstered by safe-haven demand amid ongoing geopolitical uncertainty and the approaching U.S. presidential election. The election has played a key role in supporting the dollar, as market participants remain cautious about potential volatility in the financial markets. Traders will watch for key levels to gauge whether a reversal is on the horizon.

GBP/USD remain trading within its bearish trajectory but the bearish momentum is seemingly easing. The RSI remains kept below the 50 level while the MACD is edging higher from the bottom suggesting the bearish momentum is easing.

Resistance level: 1.3075, 1.3140

Support level: 1.2910, 1.2850

The upcoming U.S. election is anticipated to significantly influence the Euro’s performance, with tariffs expected to be a major focus under various election outcomes, according to Goldman Sachs. A Republican sweep could lead to a substantial strengthening of the U.S. dollar, which may result in downward pressure on the Euro, as investors flock to the dollar amid increased tariffs and domestic tax cuts in the U.S.

EUR/USD is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 28, suggesting the pair might enter oversold territory.

Resistance level: 1.0890, 1.0950

Support level: 1.0785, 1.0675

The USD/CAD pair has formed a higher-high price pattern and is currently trading at its recent high, indicating a bullish bias. The pair’s upward momentum is primarily driven by the robust U.S. dollar performance, while the Canadian dollar remains under pressure due to the dovish expectations surrounding the Bank of Canada’s (BoC) interest rate decision. The BoC is expected to announce a 50 bps rate cut today, and if this expectation materialises, it could further weaken the Canadian dollar, potentially driving the USD/CAD pair even higher. Traders will be closely watching the BoC’s announcement for confirmation of the expected rate cut.

The pair is trading in a higher-high price pattern, suggesting a bullish bias for the pair. The RSI has declined from the overbought zone while the MACD edge is lower, suggesting the bullish momentum is easing.

Resistance level:1.3885, 1.3965

Support level: 1.3760, 1.3700

The U.S. equity market remained relatively flat in yesterday’s session, with the Nasdaq closing marginally higher. Wall Street appears to be lacking clear direction as market participants shift their focus towards safer assets like the U.S. dollar and gold amid heightened uncertainty. However, attention is expected to turn towards Tesla’s earnings report, which is scheduled for release today. As a market leader in the tech sector, Tesla’s performance could significantly influence the Nasdaq’s price movement, potentially providing more direction for the broader market, depending on the results.

The index has formed an ascending triangle price pattern, and a break above this pattern would be a bullish signal for the index. The RSI remains at the above 50 level, while the MACD is hovering flat at above the zero line, which gives a neutral signal for the index.

Resistance level: 21070.00, 22020.00

Support level: 19700.00, 19120.00

The USD/JPY pair has broken above its uptrend channel, indicating extremely strong bullish momentum. The U.S. dollar continues to strengthen, driven by robust economic data, while the Japanese yen has weakened due to a softer-than-expected CPI reading, which missed market expectations. The BoJ Core CPI came in at 1.7%, suggesting that the Bank of Japan may delay any monetary tightening policy. This dovish outlook for the BoJ is further weighing on the yen’s performance, allowing the pair to extend its upward trajectory.

The pair remained trading on an uptrend basis after the pair rose above the 150.00 mark, suggesting a bullish bias for the pair. The RSI has broken into the overbought zone while the MACD shows signs of a rebound, suggesting a fresh bullish momentum is gaining.

Resistance level: 152.25, 153.85

Support level: 150.80, 149.40

Oil prices edged down on Wednesday after U.S. crude inventories rose more than expected, weighing on the market. According to the American Petroleum Institute, U.S. crude stocks increased by 1.64 million barrels last week, surpassing analysts’ expectations of a 300,000-barrel rise. Meanwhile, the market is closely monitoring diplomatic efforts in the Middle East, as Israel continues its attacks on Gaza and Lebanon.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 59, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 72.60, 74.75

Support level: 69.90, 67.10

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!