PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

글로벌 시장을 한 손으로 거래하세요

우리의 거래 모바일 앱은 대부분의 모바일 기기와 호환됩니다. 지금 앱을 다운로드하고 언제 어디서나 인터넷이 있는 환경이라면 PU Prime과 거래를 시작하실 수 있습니다.

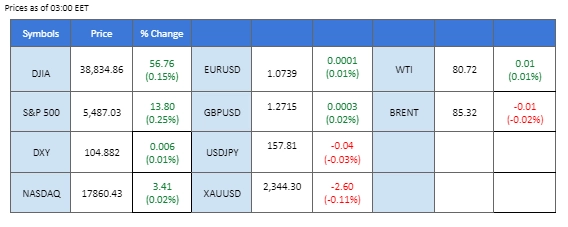

The dollar index (DXY) slid further after U.S. Retail Sales figures came in below market expectations, triggering a technical correction for the dollar. U.S. policymakers have emphasised the need for patience on rate cuts, citing the necessity for more evidence to prove that inflation is cooling. The risk-on sentiment has also buoyed the equity market, with the Nasdaq close to breaking its milestone at the 20,000 mark.

On the other hand, the Japanese Yen strengthened in the last session. The Bank of Japan (BoJ) Monetary Policy Meeting minutes revealed that board members discussed a rate hike sooner than the market had anticipated. Robust export growth in Japan may also help boost the Yen in the near future.

In the commodity market, gold prices rebounded from their liquidity zone but remained suppressed at their short-term resistance level of $2335. Conversely, oil prices were stimulated by improved market sentiment, with a more optimistic demand outlook for the latter part of 2024.

Current rate hike bets on 31st July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (91.7%) VS -25 bps (8.3%)

(MT4 System Time)

Source: MQL5

DOLLAR_INDX, H4

The Dollar Index slumped aggressively, weighed down by disappointing U.S. economic data. The U.S. Census Bureau reported Core Retail Sales for the past month at -0.10%, falling short of market expectations of 0.20%. Similarly, Retail Sales increased by just 0.10%, below the anticipated 0.30%. This weaker-than-expected consumer spending, coupled with previously low inflation data, has raised the likelihood of the Federal Reserve cutting interest rates earlier than projected.

The Dollar Index is trading lower while currently near the support level. MACD has illustrated increasing bearish momentum, while RSI is at 50, suggesting the index might extend its losses after breakout since the RSI retreated sharply from overbought territory.

Resistance level: 105.65, 106.35

Support level: 105.15, 104.45

Gold prices rebounded sharply following the release of downbeat U.S. economic data, increasing the likelihood of a Fed rate cut and enhancing gold’s appeal as a safe-haven asset. Initially, gold prices had retreated as investors took profits ahead of crucial data releases. However, post-release, investors shifted their portfolios towards gold, citing increased uncertainties over the U.S. economic outlook.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 56, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 2330.00, 2360.00

Support level: 2295.00, 2265.00

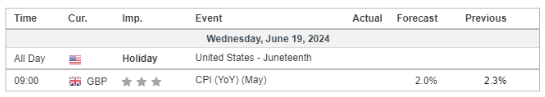

The Pound Sterling has eased from its bearish momentum and recorded a technical rebound, partly due to the weakening dollar following disappointing U.S. Retail Sales figures. With market speculation regarding the Fed’s timetable for rate cuts, Sterling traders are now focusing on today’s UK CPI reading to gauge the direction of the Bank of England’s (BoE) monetary policy and its implications for Sterling’s strength. The CPI data will provide crucial insight into the BoE’s future actions, potentially impacting the currency’s performance in the near term.

GBP/USD has formed a higher high price pattern from its recent low level, suggesting a potential trend reversal for the pair. The RSI is moving upward from near the oversold zone, while the MACD has crossed below the zero line, suggesting the bearish momentum has eased.

Resistance level: 1.2760, 1.2850

Support level: 1.2660, 1.2540

The EUR/USD pair continues to gain from its monthly low level but has approached its critical liquidity zone and may face strong selling pressure at such levels. The euro was stimulated by a slight increase in the region’s CPI readings released yesterday, while the ZEW economic sentiment has also improved, fueling the upward momentum for the pair.

EUR/USD has gained and reached its resistance level at near 1.0740. A break above such a level suggests a bullish signal for the pair. The RSI rebounded slightly from the oversold zone, while the MACD has been gaining and is approaching the zero line from below, suggesting that the bullish momentum is gaining.

Resistance level: 1.0805, 1.0860

Support level: 1.0660, 1.0615

The U.S. equity market, particularly Artificial Intelligence shares, maintained significant bullish momentum. Nvidia surged, outperforming Microsoft, and became the most valuable company, driving the broader tech sector higher despite economic data suggesting a more pessimistic U.S. outlook. Nvidia Corporation (NASDAQ: NVDA) rose more than 3%, increasing its market cap to $3.34 trillion, surpassing Microsoft’s $3.31 trillion. The optimism surrounding AI continues to overshadow broader economic concerns, propelling tech stocks to new heights.

Nasdaq is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 82, suggesting the index might enter overbought territory.

Resistance level: 20125.00, 20650.00

Support level: 19710.00, 19390.00

The Japanese Yen strengthened in the last session, with the USD/JPY pair forming a double-top price pattern, indicating a potential trend reversal. The recent release of the BoJ monetary policy meeting minutes revealed that policymakers discussed the possibility of an early rate hike, further boosting the Yen’s strength. This shift in policy outlook has increased market speculation about the BoJ’s next moves and added upward pressure on the Yen.

USD/JPY has formed a double-top price pattern, which suggests a potential trend reversal for the pair. The RSI eased from near to the overbought zone while the MACD edge lowered and is on the brink of breaking below the zero line, suggesting a bearish momentum may be forming.

Resistance level: 158.45, 159.50

Support level: 157.20, 156.15

Crude oil prices rebounded sharply despite the pessimistic economic outlook, driven by the depreciating U.S. Dollar. Investors shifted their portfolios towards dollar-denominated oil. Additionally, the market’s expectation of rate cuts from global central banks, which could boost future economic activity and oil demand, contributed to the bullish sentiment. Positive projections from OPEC+ and the International Energy Agency (IEA) further supported the oil market, suggesting that rate cut expectations and optimistic demand forecasts might continue to enhance oil’s appeal.

Oil prices are trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 70, suggesting the commodity might enter overbought territory.

Resistance level: 79.85, 81.85

Support level: 78.45, 77.10

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!