PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

글로벌 시장을 한 손으로 거래하세요

우리의 거래 모바일 앱은 대부분의 모바일 기기와 호환됩니다. 지금 앱을 다운로드하고 언제 어디서나 인터넷이 있는 환경이라면 PU Prime과 거래를 시작하실 수 있습니다.

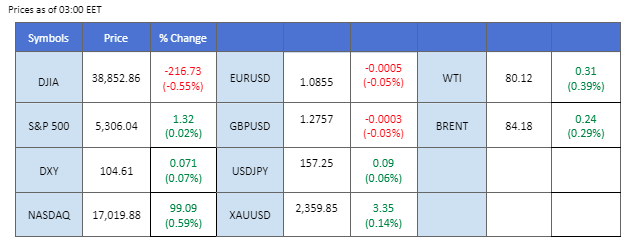

As U.S. markets resumed following the Monday public holiday, the implementation of the “T +1” settlement rule was overshadowed by a hawkish tone from the Federal Reserve. The Nasdaq and S&P 500 closed unchanged, while the Dow Jones declined. Fed official Neel Kashkari indicated that the Fed would maintain its restrictive monetary policy and did not rule out the possibility of further rate hikes.

The dollar edged higher, buoyed by the Fed’s stance. Market participants are also awaiting today’s U.S. Beige Book release for insights into the economy and its implications for the dollar.

Geopolitical tensions in the Middle East have intensified, driving oil prices up by more than 3% since the start of the week. Gold prices also ticked higher amid the uncertainty. Meanwhile, the downbeat Bank of Japan (BoJ) core CPI weighed on the Japanese yen, which traded lower against most major currencies.

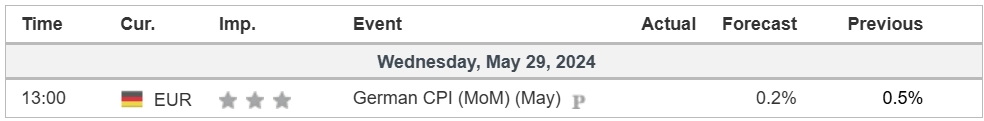

Current rate hike bets on 12nd June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (99.10%) VS -25 bps (0.90%)

(MT4 System Time)

Source: MQL5

The Dollar Index, which measures the greenback against a basket of six major currencies, rebounded slightly following better-than-expected consumer confidence data, which pushed US Treasury yields to a four-week high. The Conference Board’s Consumer Confidence Index rose to 102.0 from 97.5, surpassing market expectations of 96.0, indicating improved economic sentiment in the United States. This week, the spotlight remains on the US Personal Consumption Expenditures (PCE) index, due on Friday, with investors closely monitoring the data for further trading signals.

The Dollar Index is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 53, suggesting the index might extend its gains toward resistance level since the RSI stays above the midline.

Resistance level: 104.65, 105.25

Support level: 103.90, 103.15

Gold prices continued to rise despite the strengthening US Dollar and increasing US Treasury yields, as investors shifted towards the safe-haven asset ahead of significant inflation data releases later this week. With uncertainties surrounding the global inflation outlook and mixed signals from Federal Reserve officials, gold maintained its appeal as a stable investment.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 50, suggesting the commodity might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 2365.00, 2395.00

Support level: 2335.00, 2285.00

The GBP/USD pair experienced a technical retracement after reaching a recent high of 1.2800. The dollar strengthened as Federal Reserve officials delivered hawkish statements, indicating the potential for further rate hikes if inflation remains persistent. Traders are also closely watching today’s U.S. Beige Book release for insights into the U.S. economy and to gauge potential future monetary policy moves by the Fed.

GBP/USD touched its highest level since March but was followed by a retracement, and the bullish momentum eased. The RSI declined before getting into the overbought zone, while the MACD hovering close to the zero line suggests the bullish momentum is easing.

Resistance level: 1.2850, 1.2940

Support level: 1.2660, 1.2600

The EUR/USD pair slid as the dollar strengthened following hawkish statements from Federal Reserve officials, contrasting with the European Central Bank’s (ECB) stance suggesting a potential rate cut in June or July. Recent upbeat U.S. economic indicators and persistent inflation have led Fed members to maintain a hawkish outlook on upcoming monetary policy moves.

The EUR/USD pair face strong selling pressure at below 1.0900 levels. The RSI is hovering between 50 levels while the MACD fluctuates at the zero line, giving a neutral signal for the pair.

Resistance level: 1.0920, 1.1000

Support level: 1.0805, 1.0735

The USD/JPY ticked higher, nearing its highest level in May. The strengthening U.S. dollar exerted further downside pressure on the yen, which remains lacklustre due to Japan’s economic performance, putting the Bank of Japan (BoJ) in a dilemma regarding a shift in monetary policy. The divergence between the Fed’s hawkish stance and the BoJ’s cautious approach may continue to push the pair higher.

The pair’s edge higher from its price consolidation range suggests a bullish bias. The RSI is on the brink of breaking into the overbought zone, while the MACD is flowing flat above the zero line, suggesting the pair remains trading with bullish momentum.

Resistance level: 157.90, 159.50

Support level: 156.60, 155.00

The tech-heavy Nasdaq index continued its upward trajectory, reaching a record high, driven by a 7% surge in Nvidia shares amid ongoing AI-led optimism. Nvidia solidified its position as the third most valuable company on Wall Street, buoyed by strong quarterly results and guidance highlighting robust demand for AI chips. Despite the Nasdaq’s gains, rising US Treasury yields limited the broader stock market’s upside.

Nasdaq is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 70, suggesting the index might enter overbought territory.

Resistance level: 19125.00, 19690.00

Support level: 18430.00, 17850.00

Oil prices extended gains as investors anticipated the upcoming OPEC+ meeting later this week. The market expects OPEC+ to consider production cuts in response to recent price dips. However, uncertainties remain, including key inflation reports due this week, which could limit gains in the volatile oil market. Investors are advised to monitor the EIA oil inventories report and outcomes from the OPEC+ meeting for further trading signals.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 59, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 79.85, 82.00

Support level: 76.90, 75.55

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!