-

- 거래 조건

- 계좌유형

- 스프레드, 비용 & 스왑

- 입금 & 출금

- 수수료 & 요율

- 거래 시간

-

- 회사소개

- 회사개요

- PU Prime 리뷰

- 공지사항

- 뉴스룸

- PU Prime에 연락하기

- 고객센터

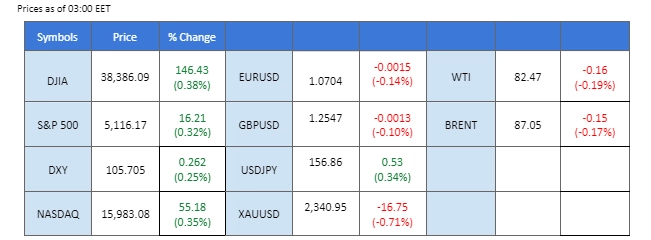

Market Summary

The Japanese Yen experienced a significant fluctuation, moving more than 500 pips against the U.S. dollar in the last trading session. This volatility was driven by market speculation regarding potential intervention by Japanese authorities after the Yen surpassed the 160 mark against the dollar. Meanwhile, market participants are also focusing on the upcoming Federal Open Market Committee (FOMC) statement scheduled for Wednesday. There is a prevailing belief that the Fed may adopt a hawkish tone in light of the U.S. economy’s robust performance.

Ahead of the FOMC statement, both the U.S. dollar and gold prices are trading steadily. Conversely, oil prices have been impacted negatively due to talks of a truce in the Middle East, which has diminished the risk premium traditionally associated with oil markets. However, the latest Chinese PMI data, indicating a second consecutive month of economic expansion in the world’s top oil importer, could lend support to oil prices.

Additionally, the release of the Eurozone’s CPI data later today will allow investors to assess inflation dynamics within the region and its potential impact on the euro. The market is also speculating about the possibility of an early rate cut by the European Central Bank (ECB) as inflation rates move closer to the targeted level.

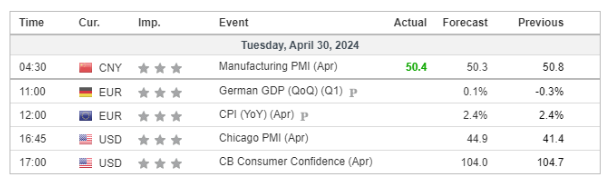

Current rate hike bets on 1st May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (97%) VS -25 bps (3%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index, mirroring the greenback’s performance against a basket of six major currencies, navigated a terrain of consolidation, delicately retracing from resistance levels in anticipation of the impending Federal Open Market Committee (FOMC) meeting. With all eyes trained on the Fed’s forthcoming deliberations, market players brace for a steady rate stance, albeit shrouded in lingering uncertainties. The spectre of a hawkish tilt looms large, buoyed by robust inflation metrics, notably the US Core Personal Consumption Expenditures (PCE) Price Index, which outpaced expectations.

The Dollar Index is trading flat while currently testing the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 48, suggesting the index might experience a slight rebound as the RSI moves forward toward the midline.

Resistance level: 106.35, 107.05

Support level: 105.75, 105.25

Gold prices underwent a modest retreat, driven by technical correction and profit-taking. However, the allure of the yellow metal faced headwinds from mounting hawkish fervor emanating from the Federal Reserve corridors, bolstering the appeal of the dollar and dampening demand for dollar-denominated gold. As the week unfolds, market participants pivot towards pivotal economic releases and monetary policy pronouncements, with Nonfarm Payrolls and the Federal Reserve’s policy posture poised to dictate market sentiment and shape trading trajectories.

Gold prices are trading flat while currently testing the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 49, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 2360.00, 2405.0

Support level: 2330.00, 2300.00

The GBP/USD pair continues to navigate within its established uptrend channel, with the British Pound advancing against the U.S. dollar. Sterling’s strength was supported by robust economic indicators, including a high CPI reading and strong performance in the service sector PMI. However, traders are closely watching the upcoming Federal Open Market Committee (FOMC) interest rate decision, which is expected to have a significant impact on the dynamics of the GBP/USD pair.

The GBP/USD continue to trade within its uptrend trajectory with sufficient bullish momentum. The RSI remains near to the overbought zone while the MACD continues to edge higher, suggesting the pair continue to trade with bullish momentum.

Resistance level: 1.2660, 1.2760

Support level: 1.2440, 1.2370

The EUR/USD pair has retreated from its recent high at the 1.0741 level, indicating a pause in its bullish momentum. Market participants are closely monitoring today’s Euro CPI readings, as a continued easing in CPI could prompt speculation of an early rate cut from the European Central Bank (ECB). Such speculation may hinder the euro’s strength against the U.S. dollar.

The pair has eased in its bullish rally and is currently supported at near 1.0700. Both the RSI and the MACD show signs of easing from the elevated level, suggesting that the bullish momentum is easing as well.

Resistance level: 1.0775, 1.0866

Support level: 1.0630, 1.0560

The US equity arena witnessed a spirited ascent, propelled by stellar showings from industry titans Tesla and Apple in the wake of their earnings extravaganzas, impeccably timed ahead of the FOMC rendezvous. Tesla shares surged by a commanding 15% surge, fueled by reports of a tentative nod from Beijing greenlighting the deployment of its cutting-edge driver assistance software in the lucrative Chinese market, courtesy of synergistic collaboration with tech behemoth Baidu. Meanwhile, Apple’s stock soared over 2% following a bullish upgrade from Bernstein, adding to the market fervour.

Nasdaq is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 55, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 17850.00, 18430.00

Support level: 16975.00, 16230.00

The USD/JPY pair has stabilised above the previous liquidity zone near the 155.50 level following a significant decline. This plunge was primarily fueled by market speculation regarding potential intervention by Japanese authorities, which created turbulence in the foreign exchange market. However, the rally was short-lived as there has been no concrete evidence to suggest that Japanese authorities have actively intervened to support the weakening yen.

The pair eased in volatility after yesterday’s session and is currently having a technical rebound from above its crucial liquidity zone. The RSI remained at the above-50 level, while the MACD remained above the zero line, suggesting that the bullish momentum remains.

Resistance level: 156.90, 158.35

Support level:155.70, 154.25

Oil prices experienced a slight downturn following encouraging signs of progress in ceasefire negotiations between Israel-Hamas, which assuage concerns of a potentially escalating conflict in the region. Concurrently, apprehensions regarding the trajectory of US monetary policy, with expectations leaning towards a more hawkish stance, further contributed to market jitters. According to Bloomberg, leaders convened in Cairo for a fresh round of discussions facilitated by Egyptian and Qatari mediators. Egyptian Foreign Minister Sameh Shoukry expressed cautious optimism, highlighting Egypt’s hopeful stance while awaiting feedback on the proposed plan from Israel-Hamas

Oil prices are trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 43, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 83.40, 84.95

Support level: 81.90, 80.45

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!