-

- 거래 조건

- 계좌유형

- 스프레드, 비용 & 스왑

- 입금 & 출금

- 수수료 & 요율

- 거래 시간

-

- 회사소개

- 회사개요

- PU Prime 리뷰

- 공지사항

- 뉴스룸

- PU Prime에 연락하기

- 고객센터

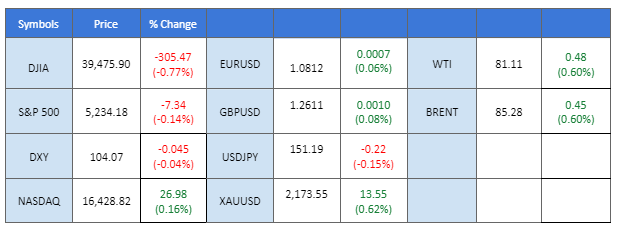

At the outset of the week, market attention is squarely focused on the upcoming release of the Fed’s preferred inflation measure, the PCE index, scheduled for Friday, alongside remarks from Federal Reserve Chair Jerome Powell following the release. Currently, the U.S. dollar is supported by persistent inflationary pressures in the country, leading strategists to revise downwards their expectations for rate cuts in 2024.

Meanwhile, the Japanese Yen has managed to marginally appreciate against the dollar, despite the Bank of Japan’s first rate hike since 2007. Market speculation and warnings from Japanese officials regarding potential currency fluctuations have contributed to the Yen’s resilience, with investors closely monitoring any potential intervention by Japanese authorities.

In the commodities market, oil prices have remained relatively flat, with traders closely monitoring developments related to ceasefire talks in Gaza over the weekend and ongoing conflict in Europe. Conversely, gold prices have found support around the $2160 level, benefiting from heightened geopolitical tensions and a slight easing in the strength of the U.S. dollar.

Current rate hike bets on 1st May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (90.0%) VS -25 bps (10%)

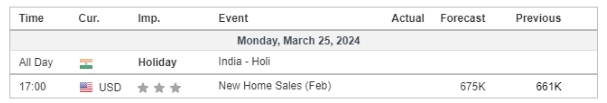

(MT4 System Time)

Source: MQL5

The Dollar Index continued its upward trajectory for a second consecutive week, bolstered by the robust performance of the US economy and heightened expectations of interest rate hikes. The potential yield disparity between the US Dollar and other major currencies remained a significant driver, underpinning the greenback’s strength. Moreover, the Fed’s upward revision of economic growth forecasts for the United States instilled confidence among investors, further reinforcing positive sentiment towards the US economic outlook.

The Dollar Index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 69, suggesting the index might enter overbought territory.

Resistance level: 104.45, 104.95

Support level:104.00, 103.65

Gold prices experienced a downturn as the robust US Dollar continued to dampen the appeal of non-yielding assets such as gold. The resurgence of the Dollar, particularly following signals from several major central banks, including the Swiss National Bank, hinting at potential rate cuts in 2024, weighed heavily on the precious metal market. Despite dovish sentiments expressed by some Fed members regarding rate cuts, the recent outperformance of the US economy could cloud the outlook for gold prices.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 64, suggesting the commodity might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 2240.00, 2315.00

Support level: 2150.00, 2080.00

The GBP/USD currency pair is exhibiting sustained bullish momentum, currently hovering near the 1.2600 level as the market anticipates further developments. Revisions in market expectations regarding a potential Federal Reserve rate cut in 2024 have emerged due to ongoing inflationary pressures in the U.S., contributing to the strengthening of the dollar. Additionally, traders are closely monitoring the upcoming release of the UK’s GDP data on Thursday, which is expected to provide insights into the economic health of the UK and its potential impact on the strength of the Sterling.

GBP/USD continues to trade with strong bearish momentum despite recording a slight rebound at near 1.2600 levels. The RSI remains near the oversold zone, while the MACD continues to edge lower, suggesting that the bearish momentum remains strong.

Resistance level: 1.2630, 1.2710

Support level: 1.2530, 1.2440

The EUR/USD pair is currently facing significant downward pressure, trading close to its key psychological support level at around 1.0800. This pressure comes amid signs of easing inflation within the Eurozone, prompting market speculation about a potential rate cut from the European Central Bank (ECB) in 2024, despite its current hawkish monetary policy stance. Concurrently, persistent inflation in the U.S. is leading the Federal Reserve to adopt a more cautious approach towards rate cuts. This divergence in monetary policy between the two central banks is expected to exert additional downward pressure on the pair.

EUR/USD recorded a technical rebound at above 1.0800 after a significant dive. The MACD continues to slide below the zero line while the RSI hovers at the lower region, suggesting that the pair remains trading with bearish momentum.

Resistance level: 1.0866, 1.0955

Support level: 1.0780, 1.0700

The Swiss Franc witnessed a significant decline against the US Dollar, prompted by the Swiss National Bank’s surprise decision to reduce its main interest rates by 25 basis points to 1.50%. This unexpected policy shift marked the Swiss National Bank as the first major central bank to backtrack on tighter monetary policies aimed at addressing inflation concerns. The delay in rate cuts by the Federal Reserve, juxtaposed with the actions of other central banks, spurred several investors to reallocate their portfolios towards the US region, capitalising on potential carry trade opportunities.

USD/CHF is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 74, suggesting the pair might enter overbought territory.

Resistance level: 0.9040, 0.9215

Support level: 0.8905, 0.8810

The AUD/USD pair has seen a rebound from its recent lows, buoyed by interventions from the Chinese government aimed at strengthening the Chinese Yuan in a bid to stabilise it amid recent weakening. Consequently, the Australian dollar, often viewed as a proxy for the Chinese economy, benefited from the stronger Yuan, experiencing an uptick in value. Traders are now shifting their focus towards the upcoming release of Australia’s Retail Sales data on Wednesday, which is anticipated to provide further insights into the strength of the Australian dollar.

The AUD/USD pair has rebounded but remains trading with a bearish trajectory. The RSI remains at the lower region while the MACD has broken below the zero line, suggesting the bearish momentum is overwhelming.

Resistance level: 0.6590, 0.6640

Support level: 0.6484, 0.6410

Crude oil prices witnessed a slight retreat amidst optimism surrounding potential ceasefire negotiations between Israel and Hamas. US Secretary of State Antony Blinken’s remarks, indicating progress in talks held in Qatar aimed at reaching a ceasefire agreement for Gaza, tempered concerns over oil supply disruptions. This development, coupled with the potential alleviation of geopolitical tensions, contributed to the easing of fears in the oil market.

Oil prices are trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 48, suggesting the commodity might experience technical corrections since the RSI rebounded sharply from oversold territory.

Resistance level: 82.85, 84.10

Support level: 80.20, 78.00

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!