PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

글로벌 시장을 한 손으로 거래하세요

우리의 거래 모바일 앱은 대부분의 모바일 기기와 호환됩니다. 지금 앱을 다운로드하고 언제 어디서나 인터넷이 있는 환경이라면 PU Prime과 거래를 시작하실 수 있습니다.

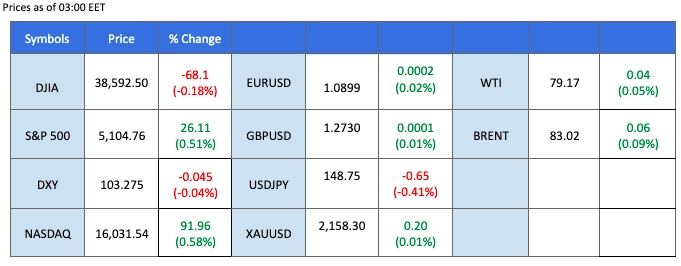

* The dollar index traded to its one-month low after a Dovish Testimony by Jerome Powell.

* The soft dollar has pushed the gold to break its all-time high levels with strong bullish momentum in sight.

* BTC rebounded and is back to $67000 territory.

The Powell testimony that began yesterday brought an unexpected statement from the Fed’s chief, putting pressure on the dollar. Powell signalled the likelihood of the U.S. central bank cutting rates this year, although without specifying when and by how much. Consequently, the dollar index plummeted nearly 0.5%, reaching its lowest levels in a month. This shift in the currency market influenced commodities positively, with gold prices hitting an all-time high above $2150, while oil prices rebounded, supported by favorable U.S. crude oil data as well. Additionally, insight from the largest Japanese bank, positioning itself for a potential BoJ monetary policy shift in March, led to a robust Japanese Yen, resulting in a nearly 0.8% drop in the USD/JPY pair.

Current rate hike bets on 20th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

(MT4 System Time)

Source: MQL5

The Dollar Index has descended to its lowest point in a month, currently trading below 103.50 levels. The dollar faced significant downward pressure primarily due to the dovish stance communicated in Powell’s testimony that began yesterday. Powell indicated an expectation that the U.S. central bank will initiate rate cuts this year. Traders are closely monitoring the upcoming Non-Farm Payrolls (NFP) report scheduled for Friday, as it may offer insights into the potential timing of the Federal Reserve’s rate-cutting actions.

The dollar index traded eased from its crucial liquidity zone and plunged to its one-month high, suggesting a bearish bias for the dollar. The RSI is on the brink of breaking into the oversold zone, while the MACD continues to decline and diverge, suggesting that bearish momentum is gaining.

Resistance level: 103.70, 104.50

Support level: 102.90, 102.00

Gold prices have surged to their all-time high levels and are currently testing the possibility of breaking above this threshold. The bullish momentum observed in gold throughout March can be attributed to the market sentiment indicating that the Federal Reserve may be considering a pivot from its current monetary policy. Simultaneously, the Bank of Japan (BoJ) is also potentially contemplating a shift in its monetary policy, raising concerns about a reduction in global liquidity. In such an environment, gold emerges as a favoured safe-haven asset for investors looking to position themselves amidst uncertainties in central bank policies.

Gold prices have risen and are attempting to break beyond their all-time highs. The RSI remains flowing in the overbought zone, while the MACD remains at an elevated level, suggesting that the bullish momentum remains strong.

Resistance level: 2155.00, 2170.00

Support level: 2140.00, 2117.90

GBP/USD sustains an upward trajectory, driven by the US Dollar’s depreciation. Despite the optimism, uncertainties loom ahead of the UK’s 2024 budget announcement before the election, with market anticipation for potential tax rate cuts. Detailed plans remain elusive, prompting investors to vigilantly monitor developments for nuanced trading signals.

GBP/USD is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 64, suggesting the pair might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level:1.2785, 1.2905

Support level: 1.2710, 1.2635

The Euro has strengthened against the dollar, reaching its highest level in over a month, propelled by a weakening dollar. Anticipation surrounds the upcoming ECB interest rate decision, with the market expecting the ECB to maintain a stance of being “in no hurry” to cut interest rates in its policy statement. This sentiment has led the Euro to trade robustly against the dollar.

The EUR/USD pair has broken from its weeks-long sideways trajectory, and a break from the above suggests a bullish bias signal for the pair. The RSI is on the brink of breaking into the overbought zone, while the MACD is moving upward, suggesting that bullish momentum is gaining.

Resistance level: 1.0954, 1.1040

Support level: 1.0866, 1.0775

AUD/USD benefits from additional US Dollar losses, aligning with a significant pullback in US Treasury yields amid speculation about an anticipated interest rate cut by the Federal Reserve in June. Ongoing developments in China warrant scrutiny, with potential stimulus measures providing temporary relief. Sustained positive economic indicators and a revival in the Chinese economy are crucial factors for fostering a robust upward trend in AUD/USD, further supported by rising commodity prices. Investors should remain attentive to these dynamics for potential trading signals.

AUD/USD is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 68, suggesting the pair might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 0.6575, 0.6615

Support level: 0.6535, 0.6485

The Japanese yen demonstrates resilience, outperforming other currencies amid hawkish expectations surrounding the Bank of Japan. Speculation of a potential interest rate increase surfaces as the country experiences a robust economic recovery. In contrast, Federal Reserve Chairman Jerome Powell hints at the prospect of interest rate cuts in the US if economic momentum persists, curbing the appeal of the dollar.

USD/JPY is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum. However, RSI is at 24, suggesting the pair might enter oversold territory.

Resistance level: 149.40, 150.80

Support level: 147.60, 146.35

Dovish remarks from Federal Reserve Chair Jerome Powell drove a pullback in US Treasury yields, elevating rate cut expectations in early June. The decline in yields amplifies the attractiveness of the equity market, fostering bullish momentum on the Dow Jones index. However, risk-off sentiment prevails ahead of pivotal US economic data releases, foreshadowing potential market volatilities in the coming week.

Dow Jones is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 45, suggesting the index might extend its losses toward support level since the RSI stays below the midline.

Resistance level: 34920.00, 40000.00

Support level: 37925.00, 36745.00

Oil prices have rebounded from their liquidity zone and maintained their previous high levels, forming a double top price pattern. The dovish stance from the Fed’s testimony has provided support for higher oil prices. Additionally, the weekly U.S. oil reports falling short of expectations suggest an improvement in oil demand in the U.S., contributing to the positive momentum in the oil market.

Oil prices have rebounded but formed a double-top price pattern, suggesting a potential trend reversal for oil prices. The RSI has been flowing in the upper territory while the MACD hovering close to the zero line suggests the oil prices remain trading with bullish momentum.

Resistance level: 81.20, 84.10

Support level: 78.65, 75.20

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!