-

- 거래 조건

- 계좌유형

- 스프레드, 비용 & 스왑

- 입금 & 출금

- 수수료 & 요율

- 거래 시간

-

- 회사소개

- 회사개요

- PU Prime 리뷰

- 공지사항

- 뉴스룸

- PU Prime에 연락하기

- 고객센터

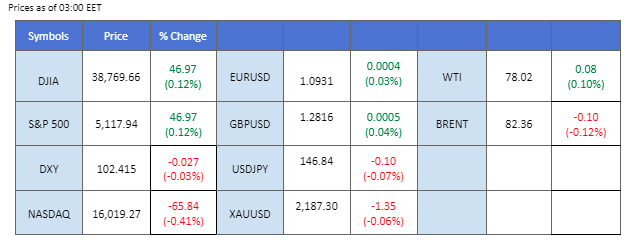

Market Summary

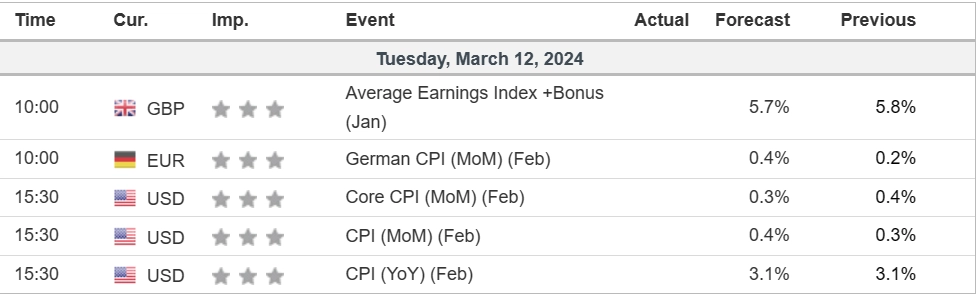

The U.S. financial markets remained relatively calm in anticipation of the forthcoming Consumer Price Index (CPI) reading, slated for release later today. This inflation data is seen as a critical determinant for market speculation on the timing of potential monetary policy moves by the U.S. Federal Reserve. Concurrently, expectations of the Bank of Japan (BoJ) making its first rate hike in decades have led to Japan’s 10-year bond yield climbing to its highest level in three months, while the Japanese Yen has exhibited strength against the dollar.

In the oil market, prices held steady around the $78 mark, with market participants closely monitoring the U.S. CPI data and the monthly report from OPEC+. These reports are expected to provide insights into the balance between demand and supply for crude oil. Additionally, Bitcoin (BTC) experienced a surge, surpassing the $72,000 mark for the first time. The cryptocurrency market has displayed a degree of independence from traditional financial markets, driven by significant capital inflows from BTC exchange-traded funds (ETFs). Notably, the London Stock Exchange’s decision to accept applications for BTC and ETH ETFs, along with Thailand’s securities regulator permitting retail investors to purchase overseas crypto ETFs, has contributed to the bullish momentum in BTC prices.

Current rate hike bets on 20th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index, tracking against a basket of major currencies, exhibited a stable performance with limited market catalysts from the US. Investors’ attention is now laser-focused on the upcoming release of the Consumer Price Index (CPI) data for February. This critical inflation report takes centre stage, carrying substantial weight on the Federal Reserve’s prospective interest rate decisions in 2024, as emphasised by Chair Jerome Powell and other key officials in recent statements.

The Dollar Index is trading flat, while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 38, suggesting the index might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 102.90, 103.70

Support level:102.10, 101.35

In a day marked by subdued market activity, the gold market exhibited resilience, maintaining a predominantly bullish outlook. The precious metal’s positive trajectory is underpinned by concerns surrounding lacklustre economic performance in the US and escalating tensions in the Middle East. With recent economic data falling below expectations, driving Treasury yields lower, gold continues to shine as a safe-haven asset, drawing investors seeking stability.

Gold prices are trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 84, suggesting the commodity might enter overbought territory.

Resistance level: 2235.00, 2350.00

Support level:2150.00, 2080.00

The Pound Sterling’s recent bullish trajectory paused at its highest point since last August, as the dollar held steady in anticipation of the upcoming U.S. Consumer Price Index (CPI) data set for release later today. Additionally, Pound traders are keenly awaiting the release of employment data from the UK, including figures on average earnings growth and the unemployment rate. These indicators are crucial for assessing the health of the UK economy and could influence the Bank of England’s monetary policy decisions moving forward.

GBP/USD has been trading strongly but experienced a technical retracement at the top but has found support at 1.2805 levels. The RSI has dropped out from the overbought zone, while the MACD has crossed on the above, suggesting the bullish momentum has eased.

Resistance level:1.2905, 1.2995

Support level: 1.2785, 1.2710

The EUR/USD pair persists in its upward trajectory, challenging a robust resistance level at 1.0955 despite the headwind. The dovish stance from the Federal Reserve is contributing to the pair’s upward momentum. Traders are currently awaiting the U.S. Consumer Price Index (CPI) reading scheduled for later today, a crucial economic indicator that can significantly influence currency movements. Simultaneously, the release of German CPI data today may also impact the strength of the euro.

EUR/USD bullish momentum has eased slightly but remains hovering at its recent peak, suggesting that it remains intact. The MACD has crossed on the top, while the RSI remains hovering in the upper region, suggesting that bullish momentum is easing slightly.

Resistance level: 1.0955, 1.1040

Support level: 1.0865, 1.0775

The Japanese Yen has shown strength against a subdued dollar, fueled by speculation of a potential Bank of Japan (BoJ) rate hike in March. This anticipation has invigorated the Yen, with the 10-year Japanese bond yield reaching its highest point in 2024, potentially acting as a bullish catalyst for the currency. Meanwhile, traders are also closely watching the U.S. Consumer Price Index (CPI), which may serve as a critical indicator for the Federal Reserve in deciding the timing of its first rate cut in the post-pandemic period.

The USD/JPY was trading with strong bearish momentum but experienced a technical rebound and may be facing a strong resistance level at below the 148 mark. The RSI has raised beyond the oversold zone, while the MACD has crossed at the bottom, which suggests the bearish momentum is easing.

Resistance level: 147.65, 149.45

Support level: 146.30, 145.00

The US equity market displayed a flat performance, coupled with a marginal dip, reflecting a prevailing sense of caution among investors. Diminishing risk appetite looms large in anticipation of pivotal events on the horizon. Market participants are anxiously awaiting the Consumer Price Index (CPI) data, which is poised to provide critical insights into the future trajectory of US interest rates and the broader economic landscape. Any deviation from expectations in this report is likely to trigger noteworthy movements in interest rate expectations and subsequently impact US Treasury yields, influencing equity markets.

The Dow is trading flat while currently near the resistance level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 47, suggesting the index might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 39400.00, 40000.00

Support level: 37915.00, 36735.00

Crude oil prices experienced a decline as investors opted for a selloff strategy to navigate potential market volatilities. Attention is now turned towards the release of monthly reports from OPEC and the International Energy Agency later in the week. These reports promise an updated perspective on the global crude demand and supply dynamics. Concurrently, a crucial US Consumer Price Index (CPI) inflation report looms large, offering additional cues on the future direction of interest rates. The decisions on interest rates will likely ripple through the oil market, influencing demand and prices. Investors are advised to stay vigilant and closely monitor these developments for nuanced trading signals.

Oil prices are trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 46, suggesting the commodity might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 78.00, 80.20

Support level: 75.95, 73.45

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!