PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

글로벌 시장을 한 손으로 거래하세요

우리의 거래 모바일 앱은 대부분의 모바일 기기와 호환됩니다. 지금 앱을 다운로드하고 언제 어디서나 인터넷이 있는 환경이라면 PU Prime과 거래를 시작하실 수 있습니다.

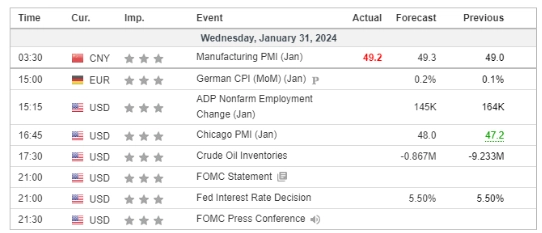

The Japanese Yen gained strength following the release of the Bank of Japan (BoJ) meeting minutes, where discussions about the potential end of the negative rate policy were noted. Some board members suggested that current conditions present a “golden” opportunity for the Japanese central bank to shift its monetary policy.

In the United States, the dollar exhibited sideways movement as traders eagerly awaited the highly anticipated Federal Open Market Committee (FOMC) meeting minutes for insights into the dollar’s strength. Concurrently, U.S. equity markets faced downward pressure due to downbeat earnings reports from mega-cap companies.

In the realm of commodities, oil prices are poised to mark their first monthly gain since September, driven by escalating tensions in the Red Sea. The recent attack on an oil tanker by a rebel group has heightened concerns, contributing to the stimulation of oil prices.

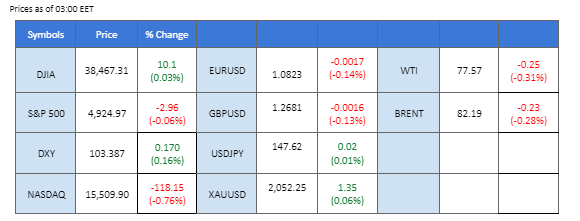

Current rate hike bets on 31 January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98%) VS -25 bps (2%)

(MT4 System Time)

Source: MQL5

The Dollar index maintains a flat trajectory in anticipation of the Federal Reserve’s impending monetary policy decisions. As the Fed is expected to keep interest rates unchanged, investors eagerly await signals from Fed Chairman Jerome Powell regarding the likelihood of a March rate cut. Recent positive economic data has shifted market expectations, with the CME FedWatch Tool reflecting a reduced probability of a March rate cut, dropping from 89% to 42% over the past month.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 48, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 103.90, 104.65

Support level: 103.15, 102.20

The gold market remains relatively flat, oscillating around a pivotal resistance level as investors grapple with uncertainty ahead of the FOMC meeting. Despite expectations that the Fed may maintain interest rates due to better-than-expected economic data, the overall bullish trend for gold persists, fueled by rising tensions in the Middle East and the precious metal’s safe-haven appeal.

Gold prices are trading flat while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 59, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 2035.00, 2055.00

Support level: 2019.00, 1985.00

The GBP/USD pair has experienced reduced volatility recently as traders adopt a wait-and-see approach ahead of upcoming interest rate decisions from both central banks. However, there is a prevailing market sentiment suggesting that the Federal Reserve is more likely to initiate rate cuts in March, while possibly maintaining interest rates unchanged in the immediate term.

GBPUSD traded sideways with marginally lower. The RSI has been flowing in the lower region while the MACD has broken below the zero line, suggesting a bearish momentum is forming.

Resistance level: 1.2785, 1.2815

Support level: 1.2610, 1.2530

The EUR/USD pair exhibited fluctuations yesterday, closely approaching its support level at 1.0831. The Euro received a boost after the unveiling of yesterday’s GDP data, which came in higher than expected, prompting the currency to trade higher against the U.S. dollar. However, these gains were short-lived, and the pair is currently trading at its recent lows as traders exercise caution ahead of the crucial Federal Reserve interest rate decision.

The EUR/USD pair is struggling to find support after the break below the descending triangle pattern, suggesting a bearish signal for the pair. The RSI has been flowing at the lower region while the MACD at below the zero line suggests the pair is trading with bearish momentum.

Resistance level: 1.0866, 1.0954

Support level: 1.0775, 1.0700

The US equity market hovers around record highs, supported by a string of better-than-expected corporate results. However, lingering uncertainties persist ahead of the FOMC meeting, with investors keenly focused on the Federal Reserve’s monetary policy decisions for guidance on future market trends.

Dow Jones is trading higher following the prior breakout above the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 73, suggesting the index might enter overbought territory.

Resistance level: 39280.00, 40000.00

Support level: 37815.00, 36600.00

The USD/JPY pair demonstrated a sideways trend with low volatility in anticipation of the Federal Reserve’s interest rate decision. The recently released Bank of Japan (BoJ) meeting minutes suggest that board members are discussing a potential shift in monetary policy, including the prospect of raising interest rates for the first time in decades. However, the impact on the pair appears to be minimal, as it continues to trade at elevated levels.

The pair remained trading above the liquidity zone but traded sideways, giving a neutral-bullish signal for the pair. The RSI flows near the 50-level while the MACD flow close to the zero line, with both indicators giving a neutral signal as well.

Resistance level: 148.67, 151.76

Support level: 146.76, 145.21

The Australian dollar experienced a slight decline against the U.S. dollar but held above its liquidity zone. The Australian Consumer Price Index (CPI) reading, coming in lower than expected at 4.1%, suggests that the Reserve Bank of Australia may opt to maintain its current monetary policy, thereby exerting pressure on the strength of the Australian dollar. Furthermore, the Chinese Purchasing Managers’ Index (PMI) readings falling short have had a negative impact on the Australian dollar, often considered a proxy for the Chinese currency.

The AUD/USD pair eased slightly but remained above its liquidity zone. The RSI flowing near the 50-level while the MACD is on the brink of breaking below the zero line suggests a bearish momentum might be forming.

Resistance level: 0.6617, 0.6712

Support level: 0.6510, 0.6390

Crude oil prices surge as the American Petroleum Institute reports a substantial 2.5 million barrel decline in weekly oil inventories, surpassing market expectations. The International Monetary Fund’s upward revision of global economic growth forecasts, particularly for the US and China, further bolsters the attractiveness of oil prices.

Oil prices are trading higher following the prior rebond from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 61, suggesting the commodity might extend its gains since the RSI rebounded sharply from midline.

Resistance level: 78.65, 80.00

Support level: 75.20, 70.25

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!